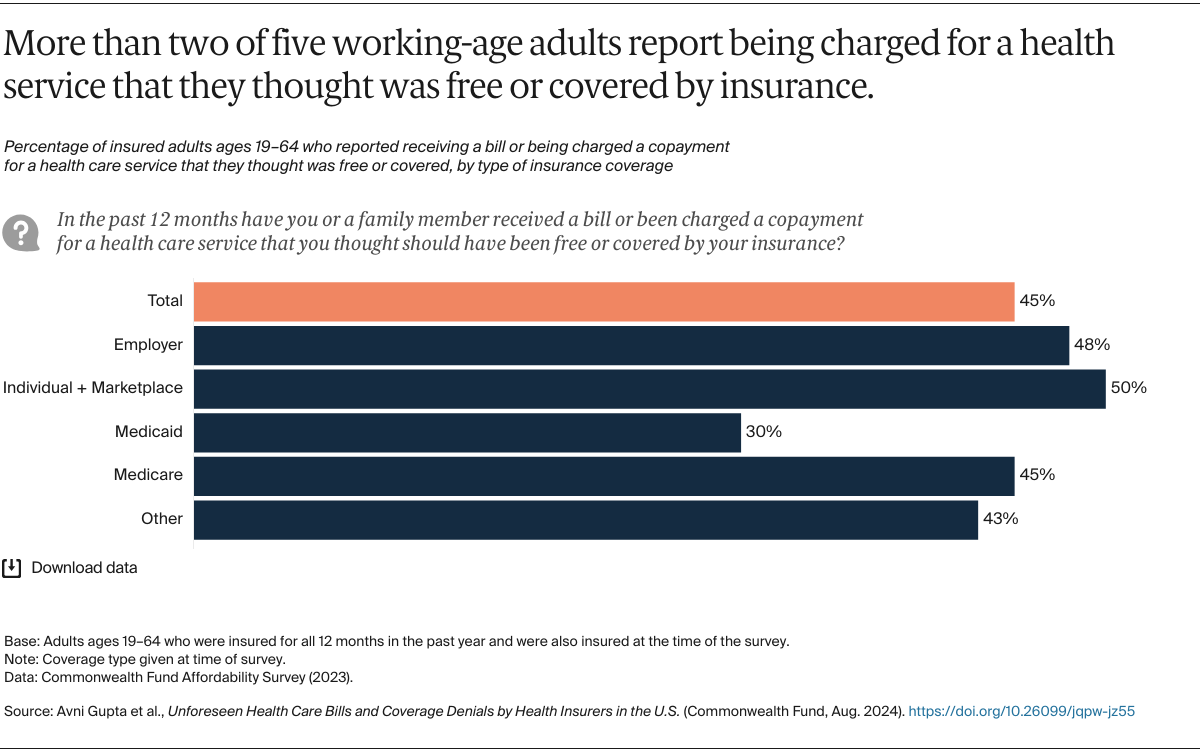

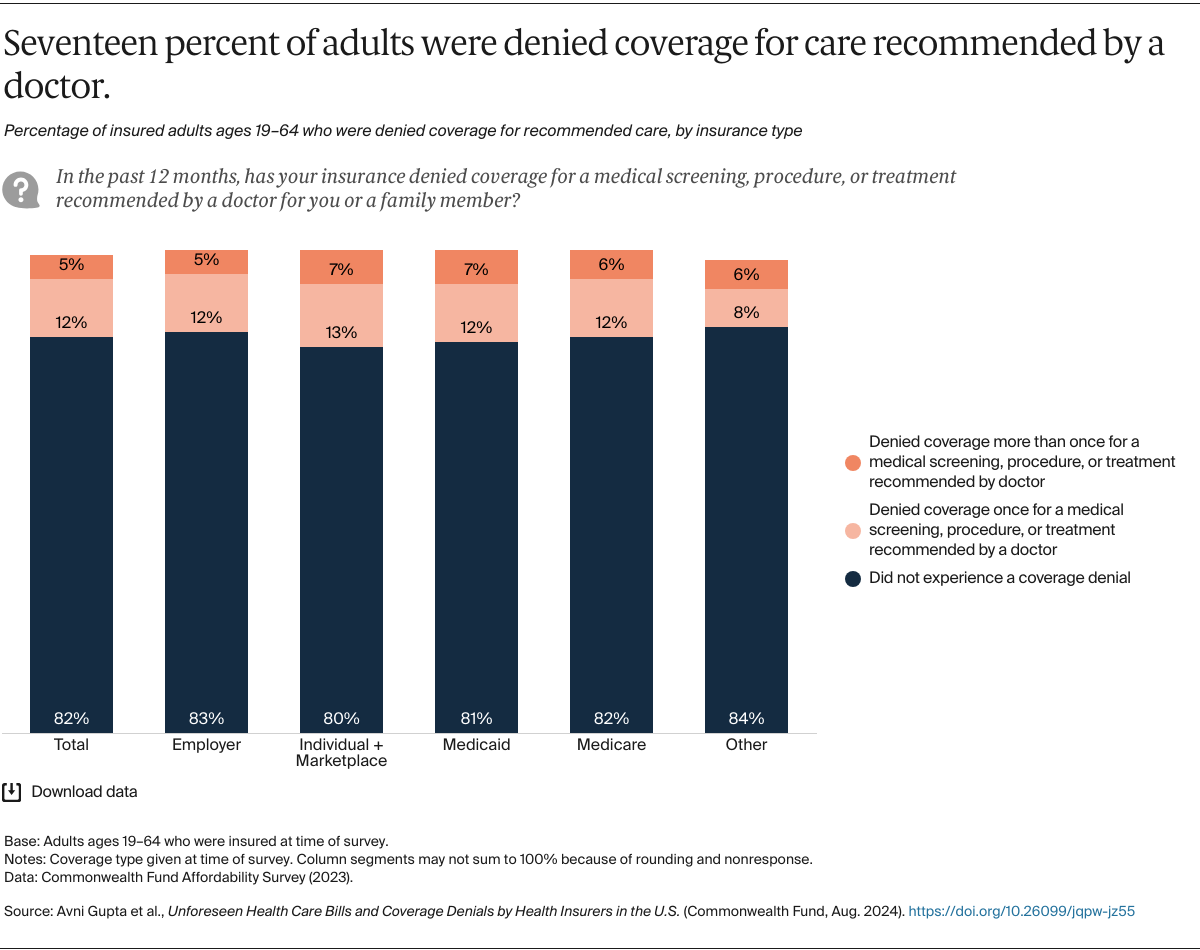

Americans are increasingly struggling to get their health insurance to work for them. High deductibles and copayments are causing nearly two of five working-age adults to delay visiting the doctor and filling prescriptions.1 Those who do get care can become burdened by medical or dental debt, something almost one-third of working-age adults report experiencing.2 Billing errors and denials of coverage by insurance companies may contribute to this problem. Media investigations have found that insurers are becoming increasingly adept in using technology to deny payment of medical claims and pressure their company physicians to deny care during prior authorization reviews.3 Doctors also report spending increasing amounts of time on the phone with insurance company physicians over denials of care for their patients.4

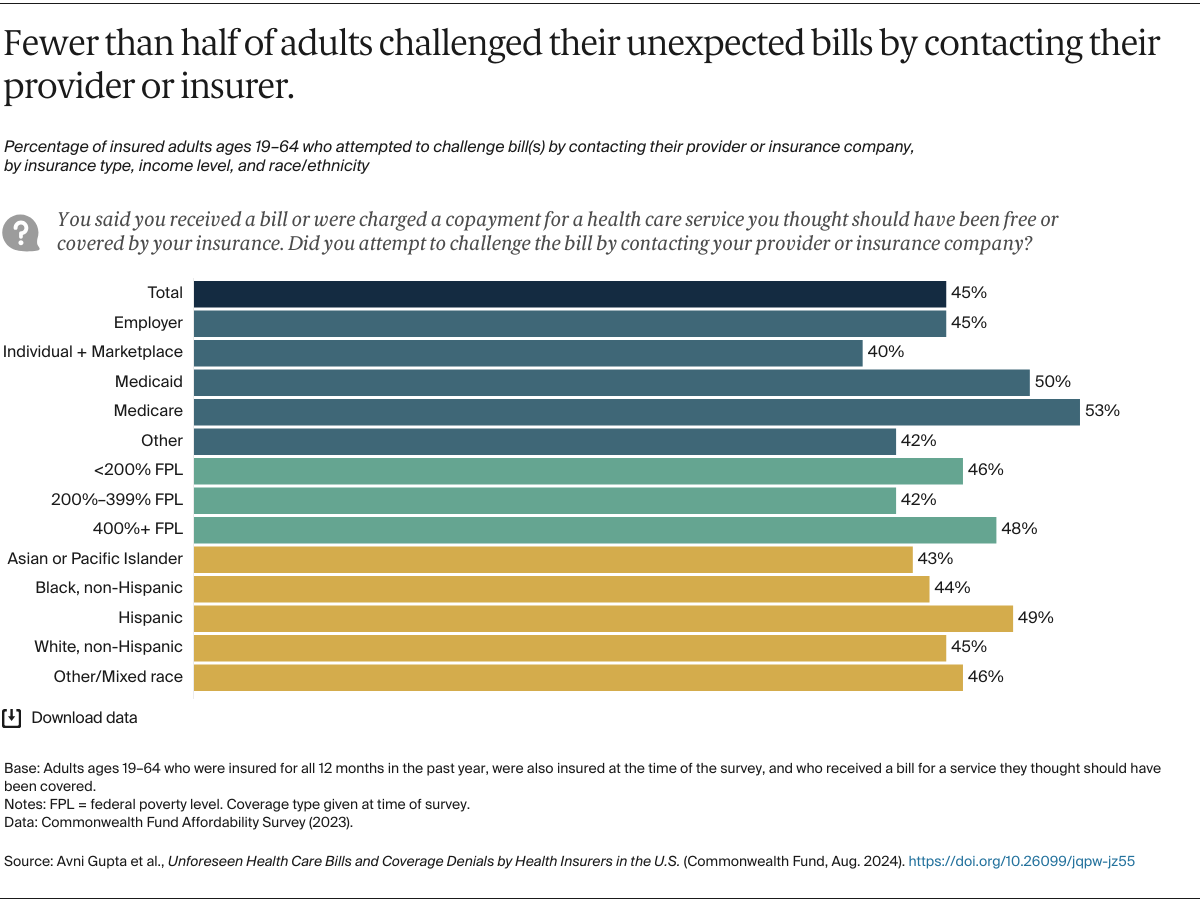

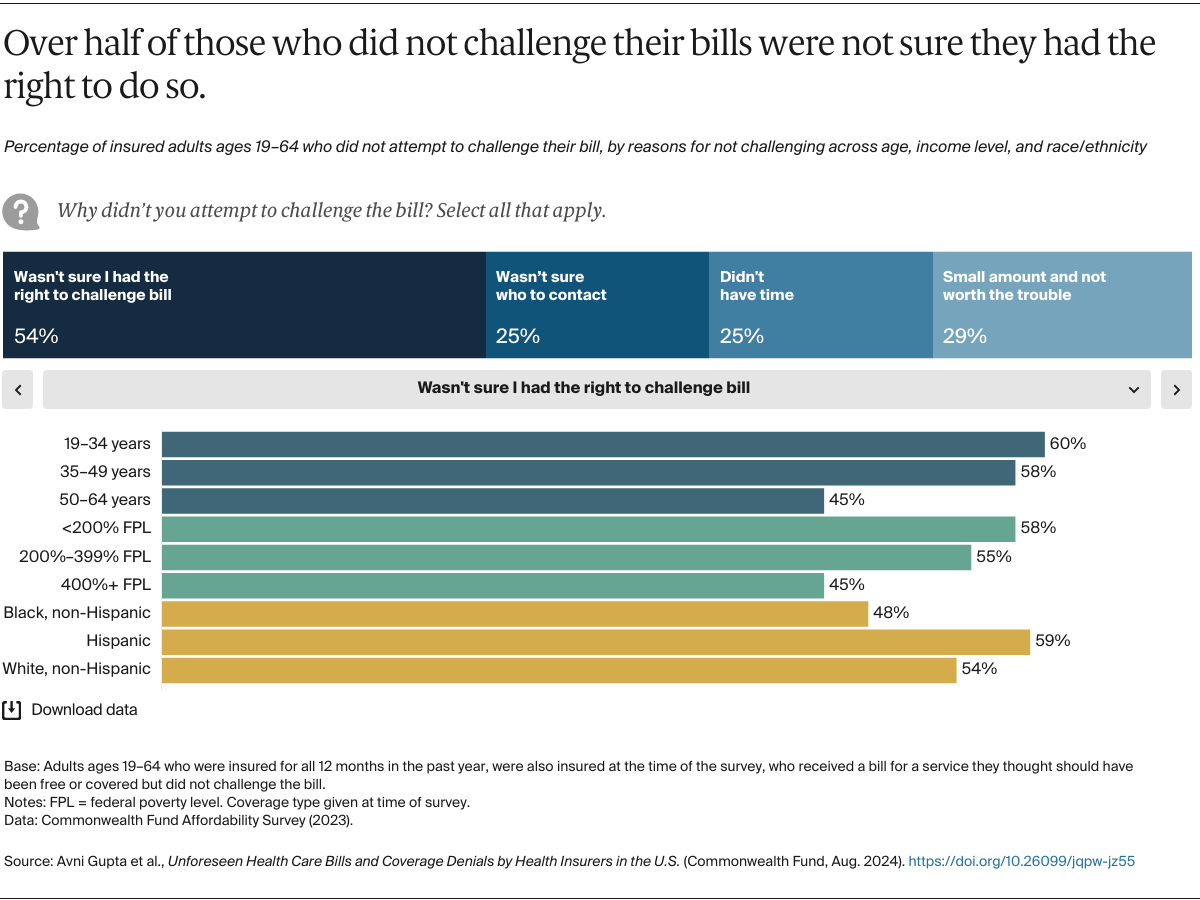

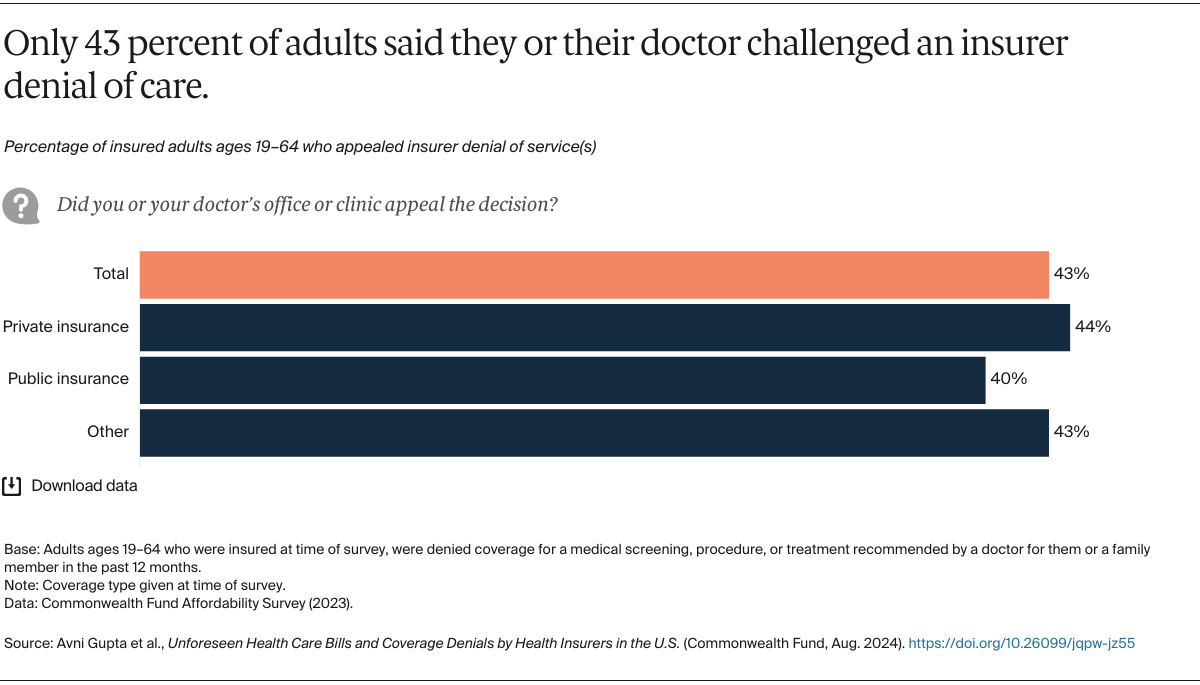

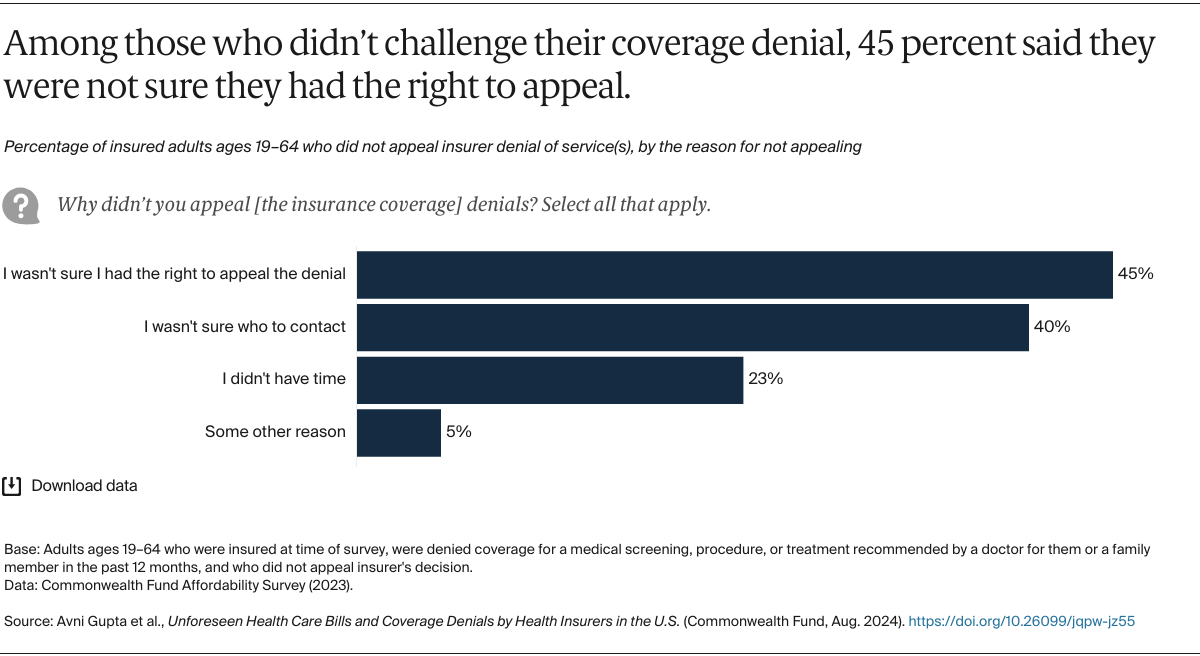

In this brief, we report findings from a Commonwealth Fund survey on the extent to which working-age adults say their insurance provider charged for a health service they thought should have been free or covered or denied coverage for care recommended by their doctors. We examined whether people challenged such errors or coverage denials, the reasons why they didn’t, and the implications for their health and well-being. People were grouped by the coverage source they reported at the time of the survey, such as employer or individual market or marketplace, though it should be noted that some may have switched insurance plans during the year.

The survey was conducted by SSRS with a nationally representative sample of 7,873 adults age 19 and older from April 18 through July 31, 2023. Our analysis focuses on the 5,602 working-age respondents — under age 65 — who were insured at the time of the survey. Analysis of billing issues was further limited to the 4,803 individuals who were insured for the entire year (see “How We Conducted This Survey” for more information).