State officials identified a few common motivations for pursuing EHB benchmark updates. States sought to add or extend benefits that advance health policy goals without risking a cost to the state. States have two pathways to require health insurers to cover certain items or services: passing a law, commonly called a state-mandated benefit, or updating their EHB benchmark plan. Under federal law, states are generally on the hook for the additional premium cost of state-mandated benefits passed after 2011, but states incur no such cost for benefits added through a benchmark update.16 State officials note their states have responded by greatly limiting, or all together avoiding, enacting mandates subject to a state cost. States that leveraged EHB updates to pursue state policy goals include Colorado, which sought to align their EHB package with broader state conversations about alternatives to opioids, and North Dakota, which sought to help residents better manage diabetes and reduce related health care costs over time by increasing access to medication for treatment.

Some states responded to complaints from consumers about barriers to care. For example, Alaska addressed concerns about lack of coverage for treatment of obesity and temporomandibular joint disorder, and North Dakota responded to complaints about lack of coverage for treatment of periodontal disease. State officials noted that EHB benchmark updates would help provide needed clarity on what is covered.

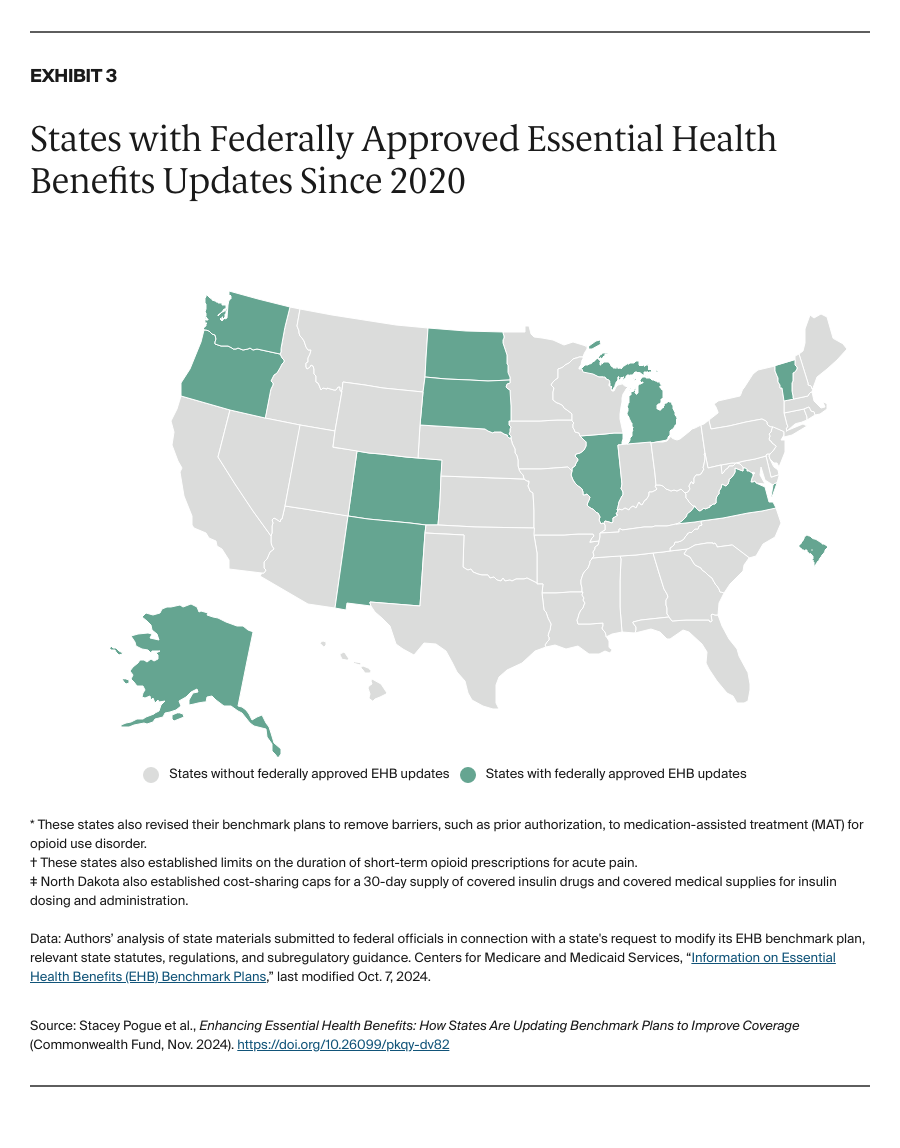

Finally, half of state officials we interviewed said their state selected a new benchmark partly because their old one was out of date. As one state official explained, “the markets have changed, and the needs have changed.” The most common benefit additions reflect states’ responses to the opioid epidemic. Six states increased access to medications that treat opioid use disorder and/or reverse overdose, and four states added alternative pain treatments, including acupuncture, chiropractic care, massage therapy, and/or nonopioid medicines for pain. In addition, four states added coverage for hearing aids, in part to more equitably improve the health and quality of life of residents.17

Federal actions and support have helped states update their EHB benchmarks and benefited consumers.

Most state officials we interviewed indicated their state relied on federal grant funding to pay for contracted actuarial analysis needed to support their federal benchmark submission.18 Only one official we interviewed indicated their state used state-appropriated funds for its EHB benchmark update.

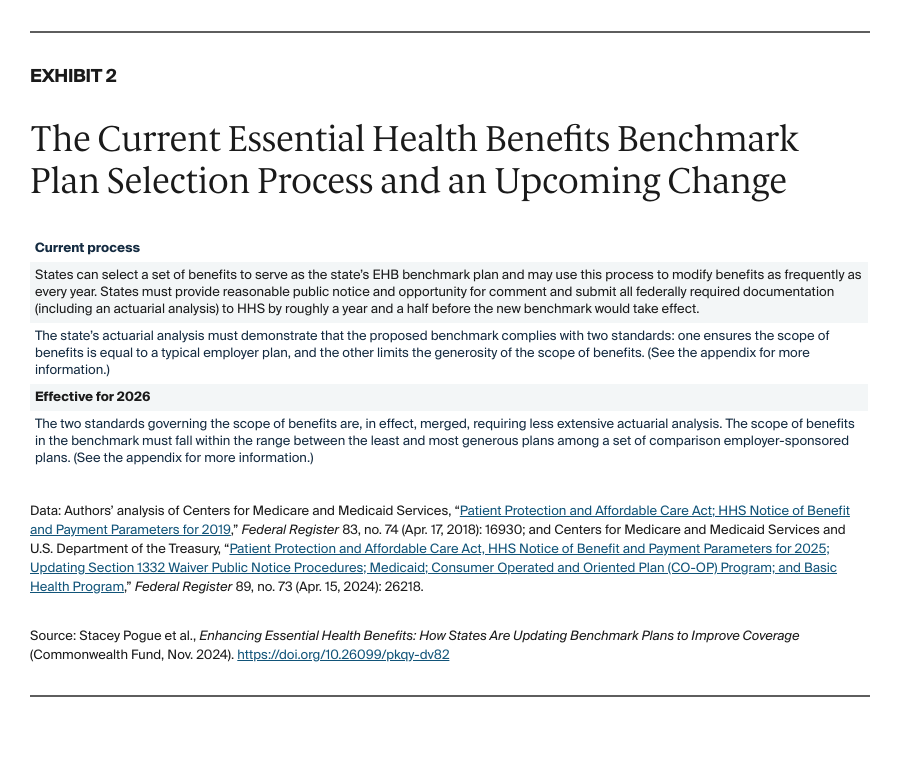

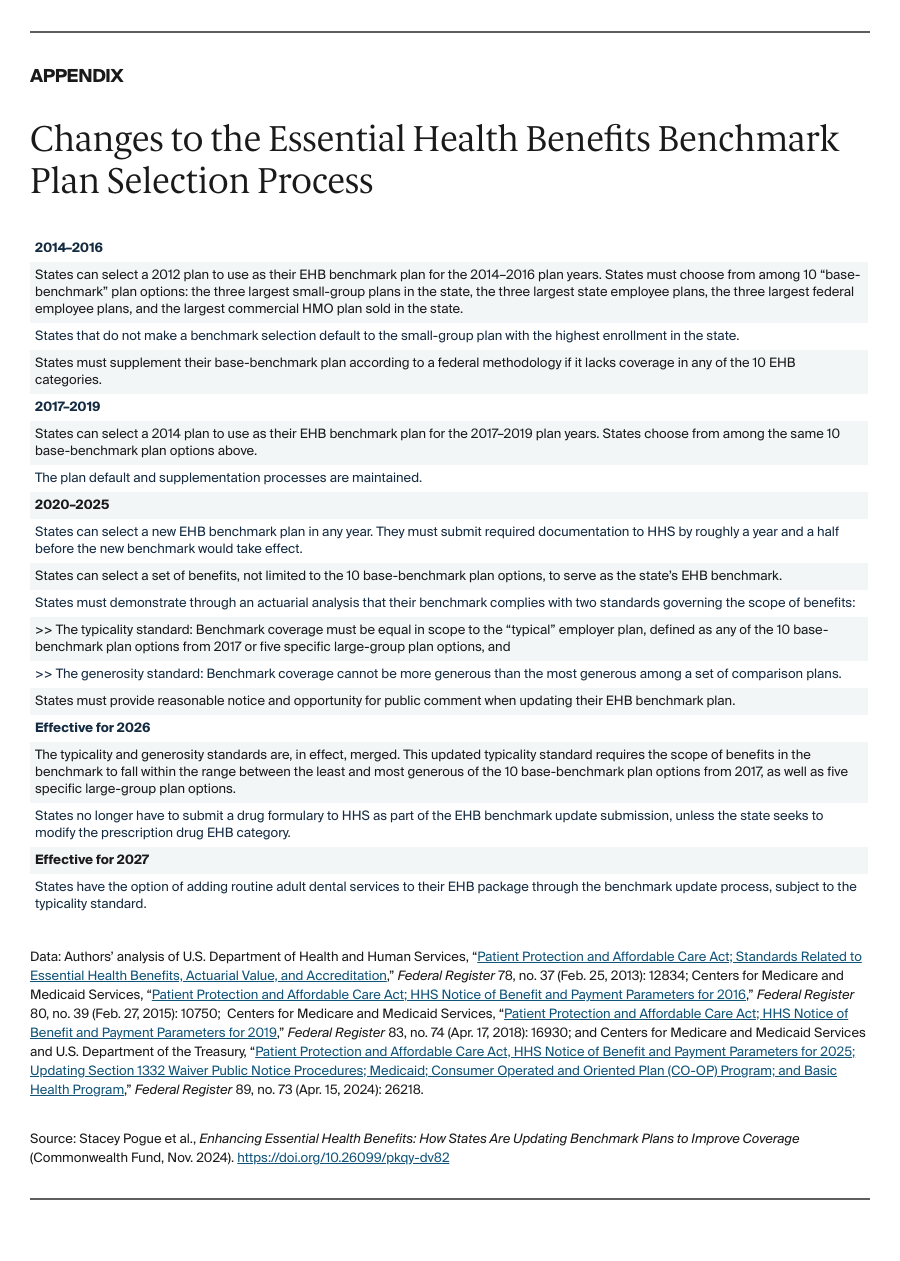

State officials reported that technical assistance from HHS during the benchmark update process was readily available and helpful. They further indicated that recent changes to streamline the EHB benchmark selection process effective for 2026 coverage were positive and would reduce unnecessary burdens on states, as intended.

In some instances, state EHB benchmark updates extended benefits for consumers on top of those proposed by their states. Because of the way the benchmark update process has worked, every state’s EHB package derives from a plan sold in 2014.19 The language in these older plans may not comply with more recent federal laws.20 Several state officials noted they worked with federal regulators during the benchmark update process to ensure language in the state’s underlying benchmark plan was brought into compliance with federal law requirements, including those related to nondiscrimination and mental health parity. This had the effect of adding federally required benefits or protections not subject to defrayal or the typicality and generosity standards (see the appendix). State officials thought these changes would help ensure EHB packages are consistently available to consumers in a manner compliant with federal law.

States face funding and capacity challenges to ensuring their EHB benchmarks remain up to date.

State officials identified the need for periodic benchmark updates to ensure EHB packages do not become outdated, but suggested cost, staff capacity, or other constraints would prevent their state from updating on an adequate cycle. Federal grants that support state EHB benchmark updates have been available sporadically, with the most recent grants awarded in September 2024.21 Many state officials said they would not have been able to update their EHB benchmark absent that funding. Only Virginia has a periodic benchmark update process in statute.22 The state general assembly passed a bill in 2023 that requires review of the state’s EHB benchmark in 2025 and every five years thereafter, and it may require a future state appropriation if federal grant funding is not available.23

State officials face challenges incorporating medical advances into EHB benchmarks.

States saw the need for updates to ensure that otherwise-static EHB benchmarks reflect continuously evolving medical advances and standards of care, but some state officials felt state departments of insurance were ill-equipped for the task. They pointed to the lack of clinical staff and expertise at departments of insurance, in particular. One state official voiced frustration with states’ inability — through either state-mandated benefits or benchmark updates — to more readily clarify the scope of an already-covered benefit to reflect medical advances when the benchmark plan language is outdated or unclear. As the National Association of Insurance Commissioners noted in recent comments to federal officials, “technological advancements in mammography have made more effective methods available, but the newer methods are not always clearly covered by older EHB descriptions.”24 Most officials we interviewed welcomed a more robust federal role for updating the EHB framework to incorporate medical advances.

Discussion

Prior to the Affordable Care Act, state-mandated benefits were the only tool states had to address inadequate benefits in state-regulated health plans, and they have trade-offs. State-mandated benefits often result in inequitable coverage that varies greatly across states and reflects, in part, which stakeholders can more effectively engage lawmakers. They are also piecemeal, often focusing on just one medical service or condition. The ACA envisions largely replacing the state-mandated-benefits approach with a process to establish and update a holistic package of essential health benefits available in every state. Federal regulators have put most pieces of this vision in place through rules and guidance, other than the statutorily required review and update of EHB.

So far, 11 states and the District of Columbia have used the flexibilities available to them to update their EHB benchmark for plan years 2020 through 2026, and new rules that streamline the benchmark update process may encourage more states to act. Yet experience suggests states will be hard-pressed to ensure their EHB packages keep pace with consumer needs and medical advances without significant federal help. Federal regulators will need to continue to support states pursuing benchmark updates with federal funding and technical assistance, but such support alone will not ensure the EHB framework evolves over time to meet the needs of consumers.

As directed in federal statute, it is ultimately the federal government’s responsibility to identify and close benefit gaps in plans subject to EHB rules and ensure required benefits keep pace with advances in science and medical evidence. Doing that will not be easy, but HHS does not have to start from scratch. In 2022, it issued a request for information on the essential health benefits that generated robust public input.25 Federal regulators can build from this foundation to develop a transparent and inclusive process for regularly reviewing and updating this federal protection.