Whether retired, nearing retirement, or living with a disability, most people with Medicare coverage live on fixed incomes. This means they’re acutely affected by the cost of their health care. While Medicare provides a guarantee of coverage for most medical services, beneficiaries still contend with copayments, deductibles, and costs for uncovered services — much like other Americans with private health insurance do.

Although most Medicare beneficiaries surveyed by the Commonwealth Fund don’t report difficulty affording their health expenses, one-third do have difficulty — a proportion that grows to one-half when focusing on beneficiaries under age 65 with disabilities. Multiple surveys have found that the share of beneficiaries saying they can’t afford needed health care generally is similar for both Medicare Advantage and traditional Medicare. In this fact sheet, we present findings on Medicare’s affordability from the latest Commonwealth Fund surveys.

Affordability of Medicare Coverage

- People age 65 and older with incomes below 200 percent of the federal poverty level were underinsured at the highest rate (37%).* There was no significant difference between people in Medicare Advantage and traditional Medicare (44% vs. 30%, respectively).

- Significantly more beneficiaries in Medicare Advantage plans than in traditional Medicare reported they couldn’t afford their care because of copayments or deductibles (12% vs. 7%).

- More than one in five (23%) adults 65 and older with Medicare reported they struggled to afford their premiums. For those with incomes under twice the poverty level, the proportion was two in five (39%).

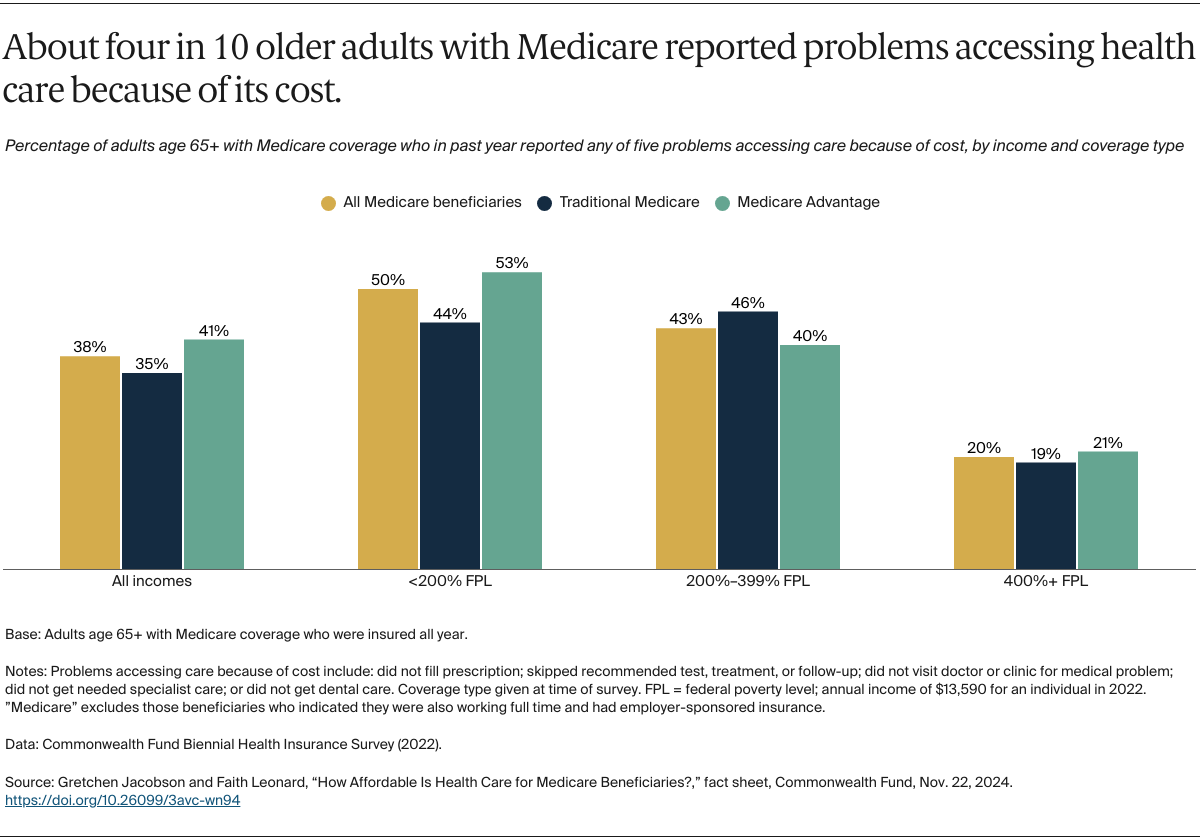

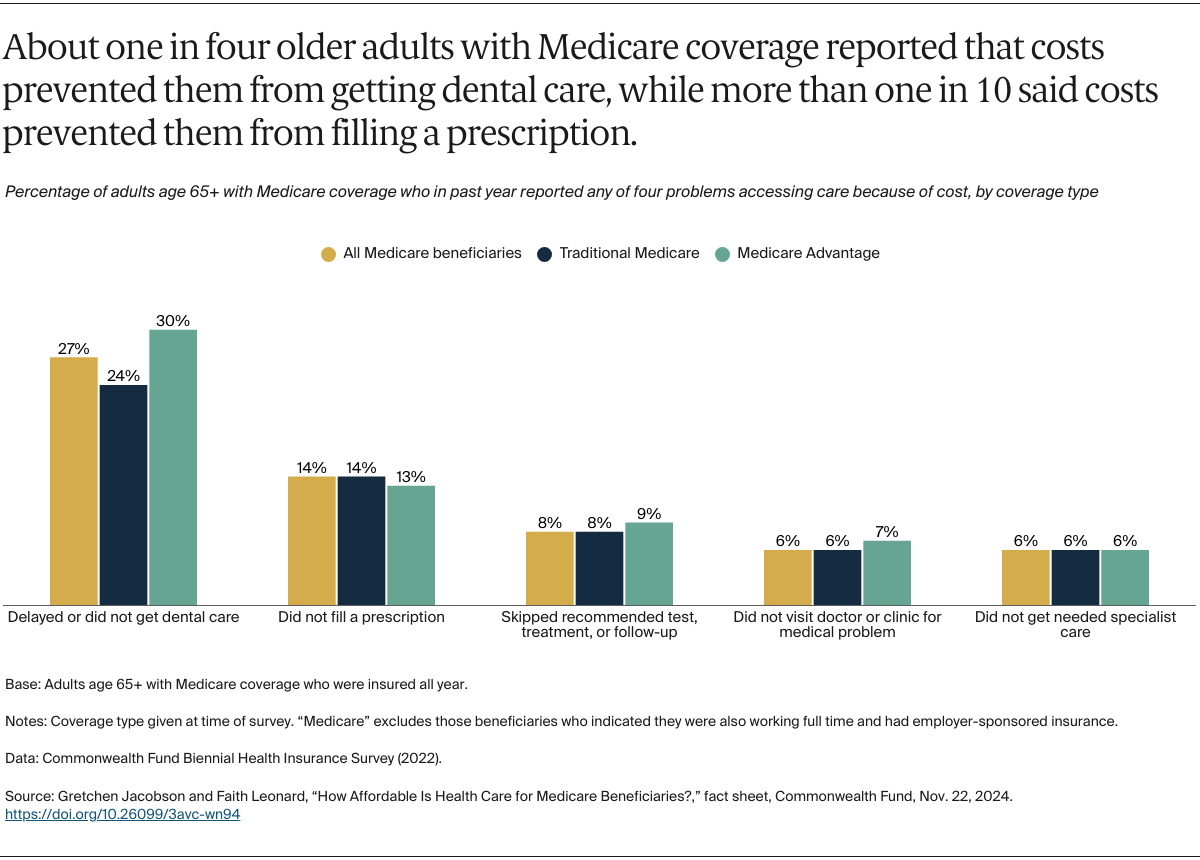

Cost Barriers to Needed Care

- More than one in five beneficiaries (21%) reported delaying or skipping needed health care because of the cost.

- More than one in five beneficiaries said health care costs made it harder for them to afford food (26%) and utility bills (23%).

- About one in six beneficiaries age 65 and older (18%) reported problems paying medical bills or debt.