Introduction

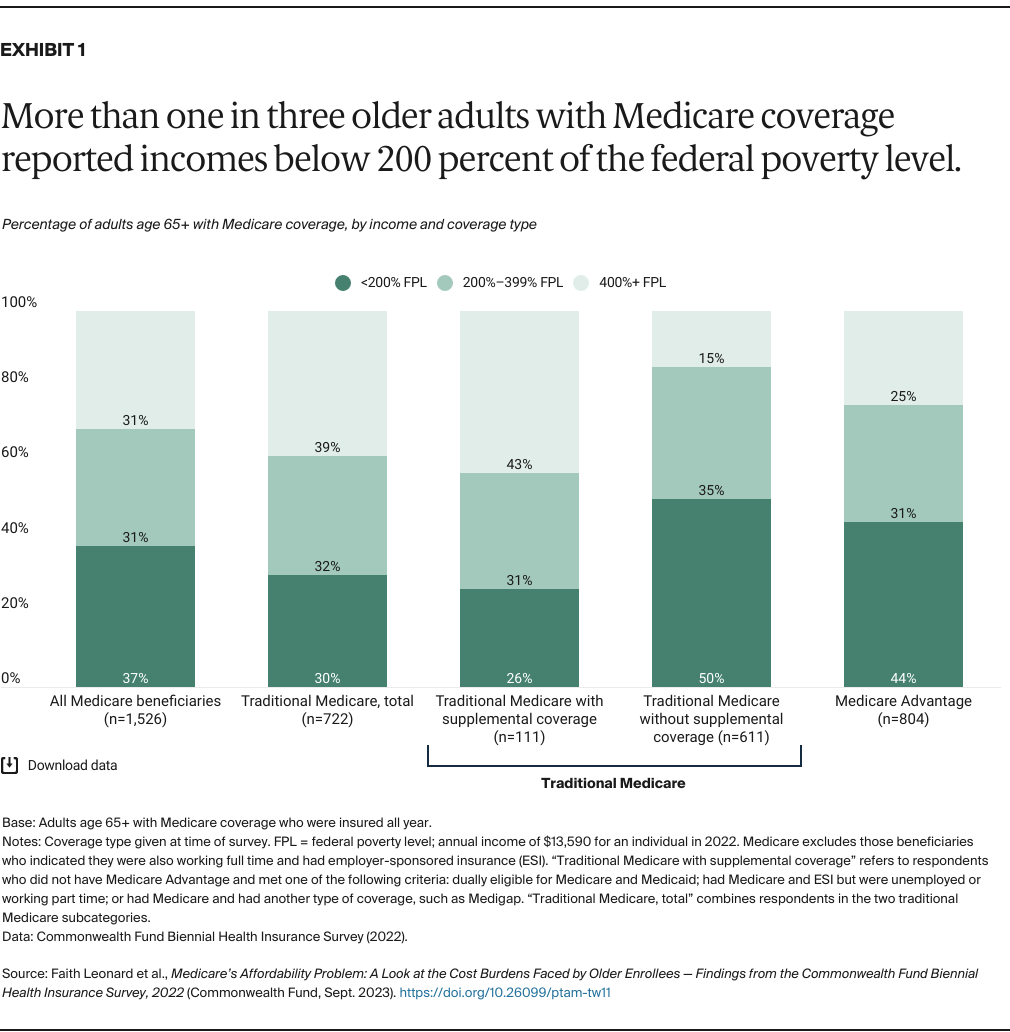

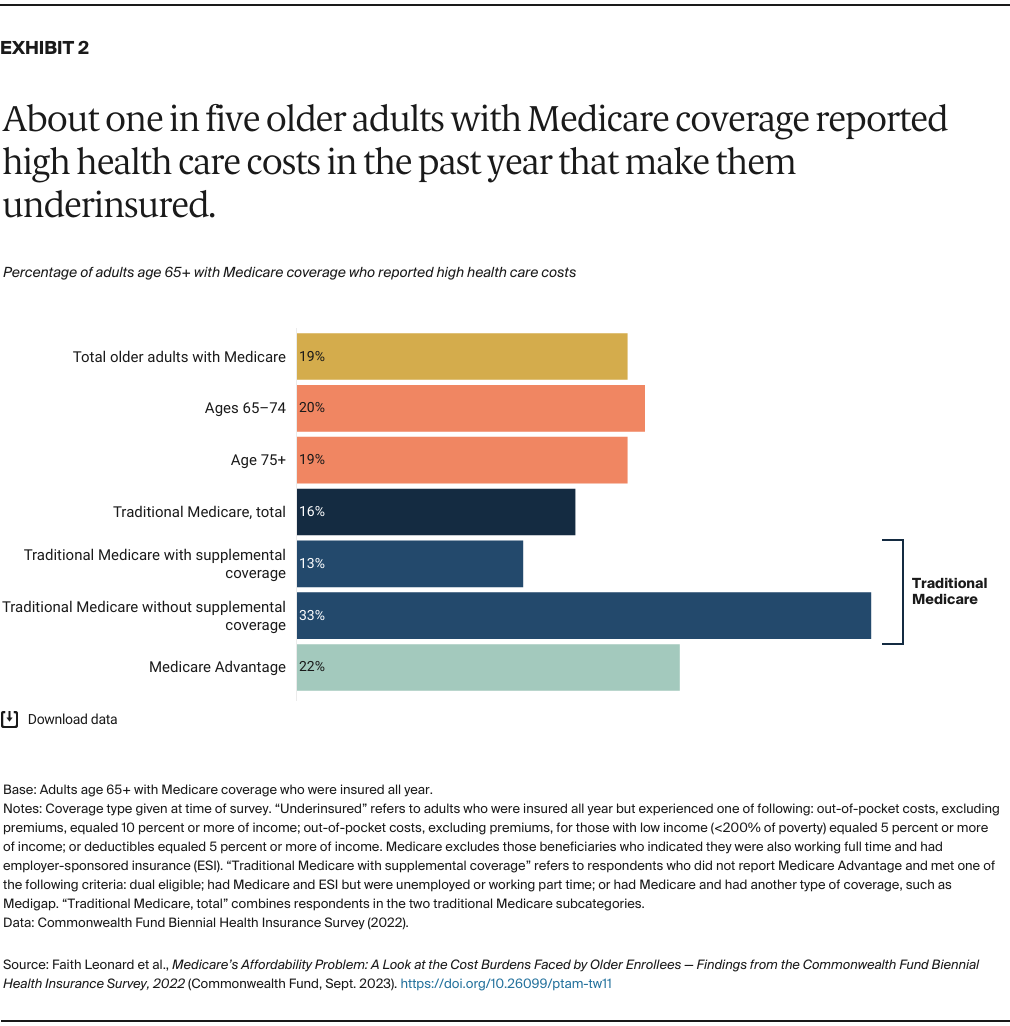

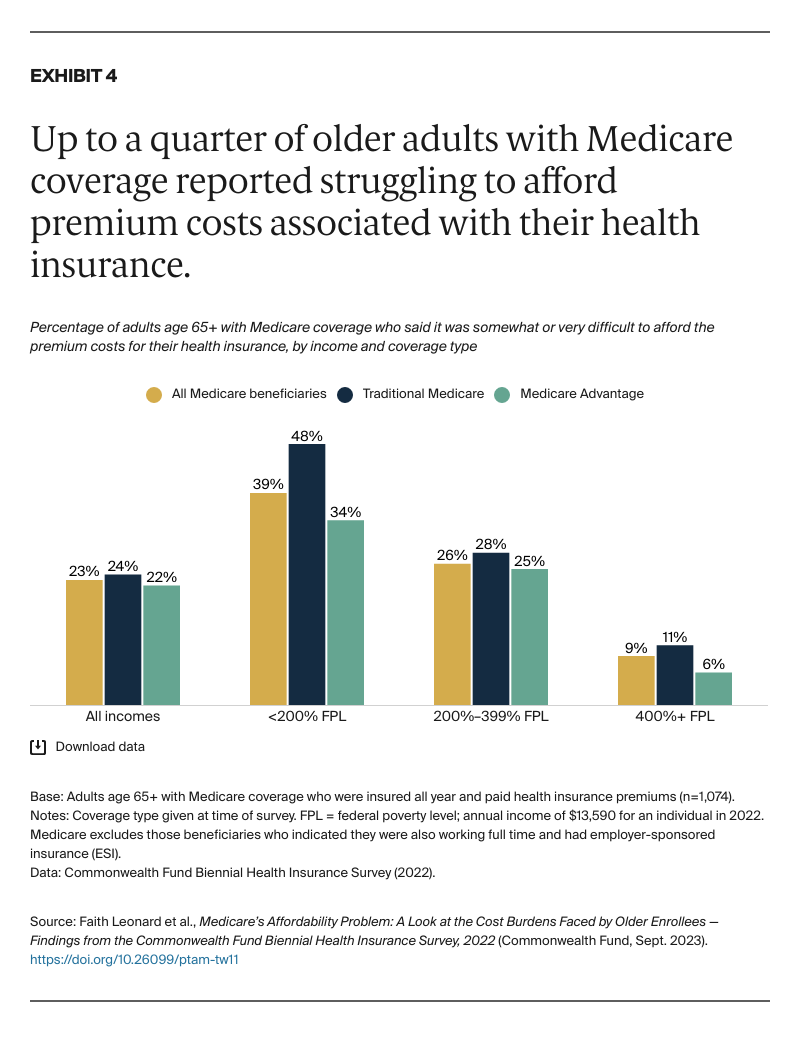

A common misconception is that once a person becomes eligible for Medicare, they no longer need to worry about medical bills or choosing a health plan. For people choosing to enroll in traditional Medicare, most have supplemental coverage to help cover the cost-sharing payments and deductibles that are required. This supplemental coverage can be either a Medigap plan that they purchase, coverage from a union or former employer, or coverage from Medicaid. Some beneficiaries in traditional Medicare can’t afford to buy a Medigap plan or are restricted from purchasing one, don’t qualify for Medicaid, or don’t have access to employer or union-based coverage.

Beneficiaries who choose to be covered through a Medicare Advantage plan — private insurance plans that contract with the federal government to provide Medicare-covered benefits — can have lower cost-sharing requirements and some coverage of benefits not included in traditional Medicare. Medicare Advantage plans, however, typically use tools, such as prior authorization requirements, to manage enrollees’ use of services, which can pose barriers to care.

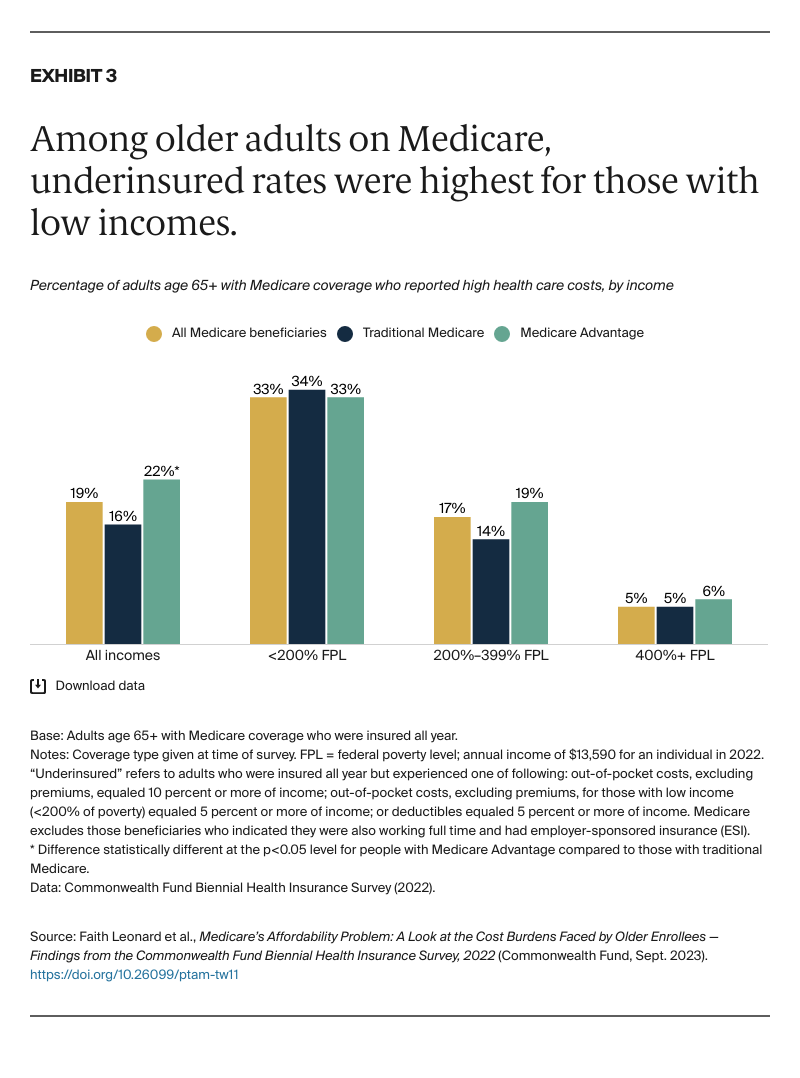

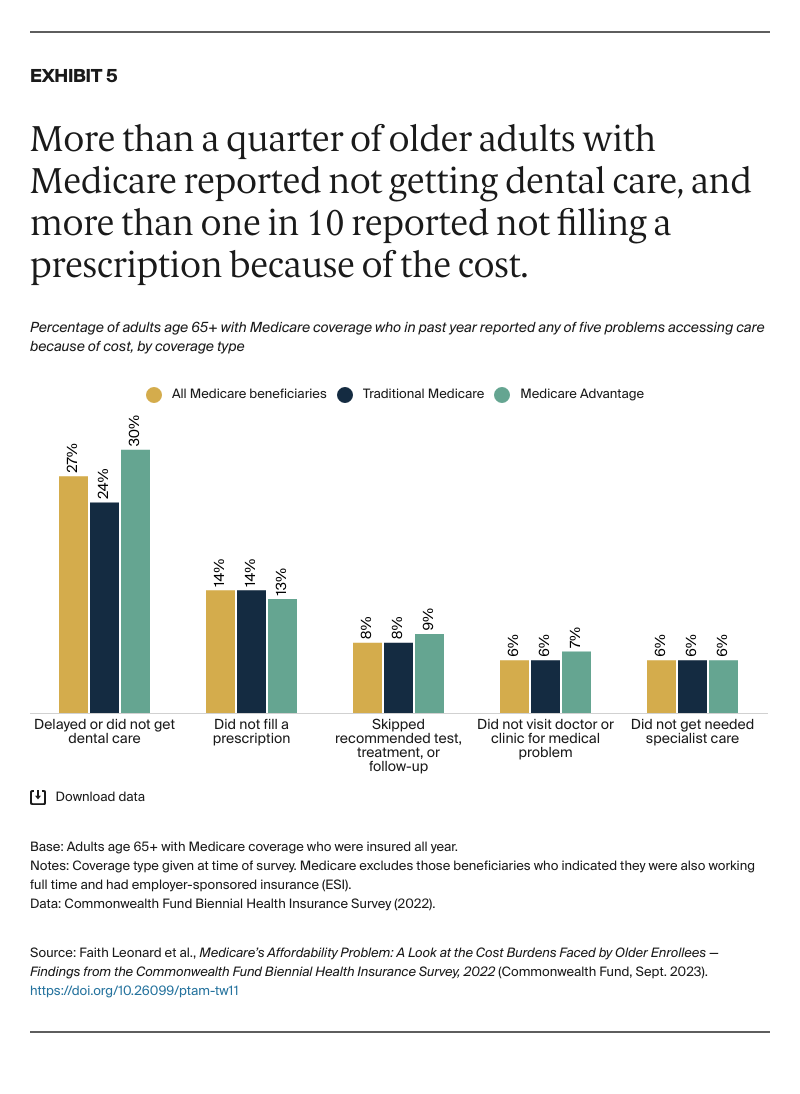

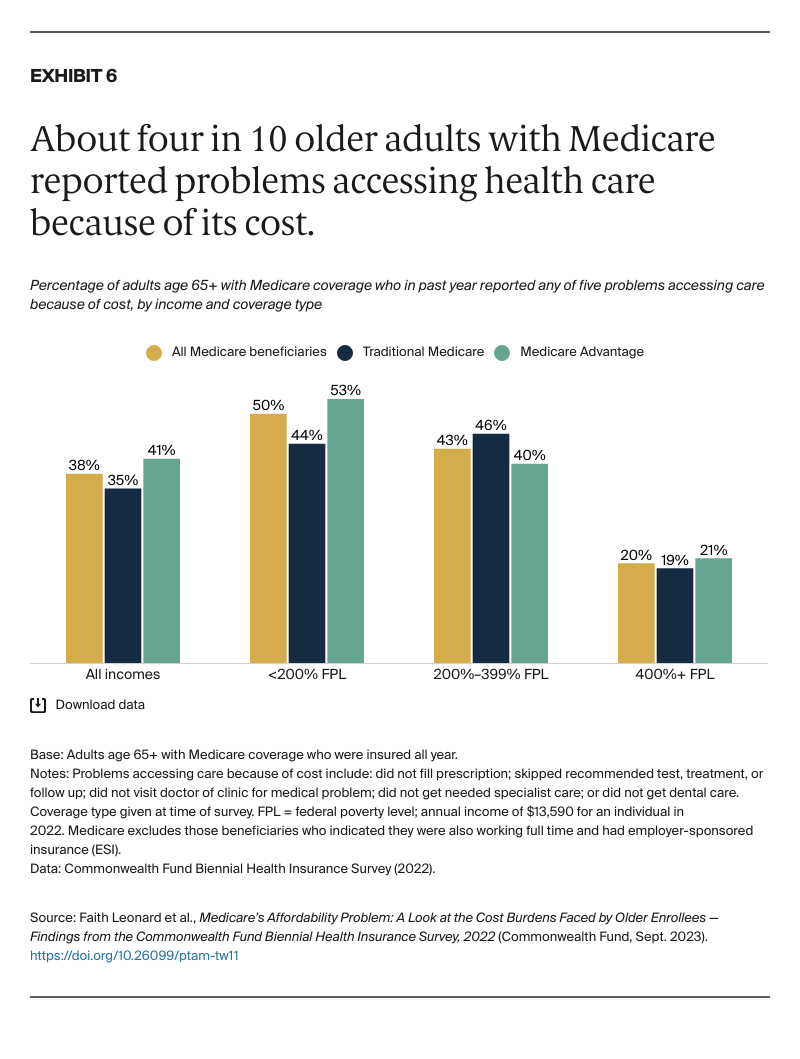

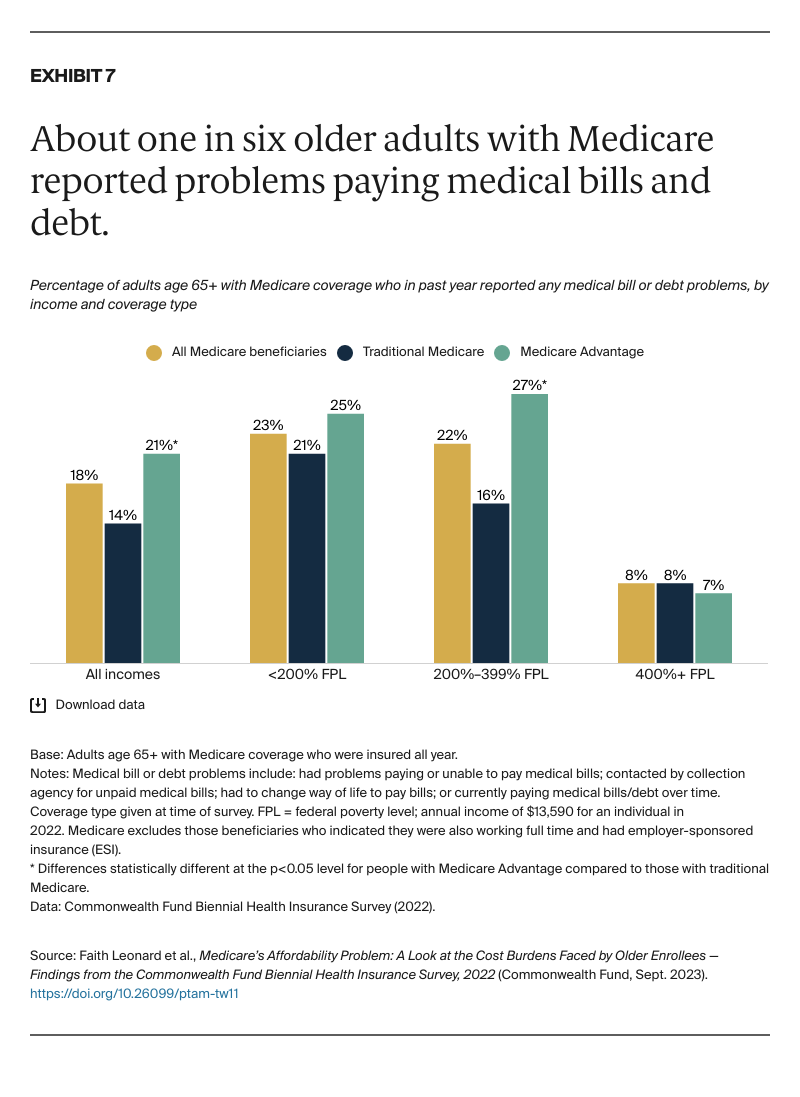

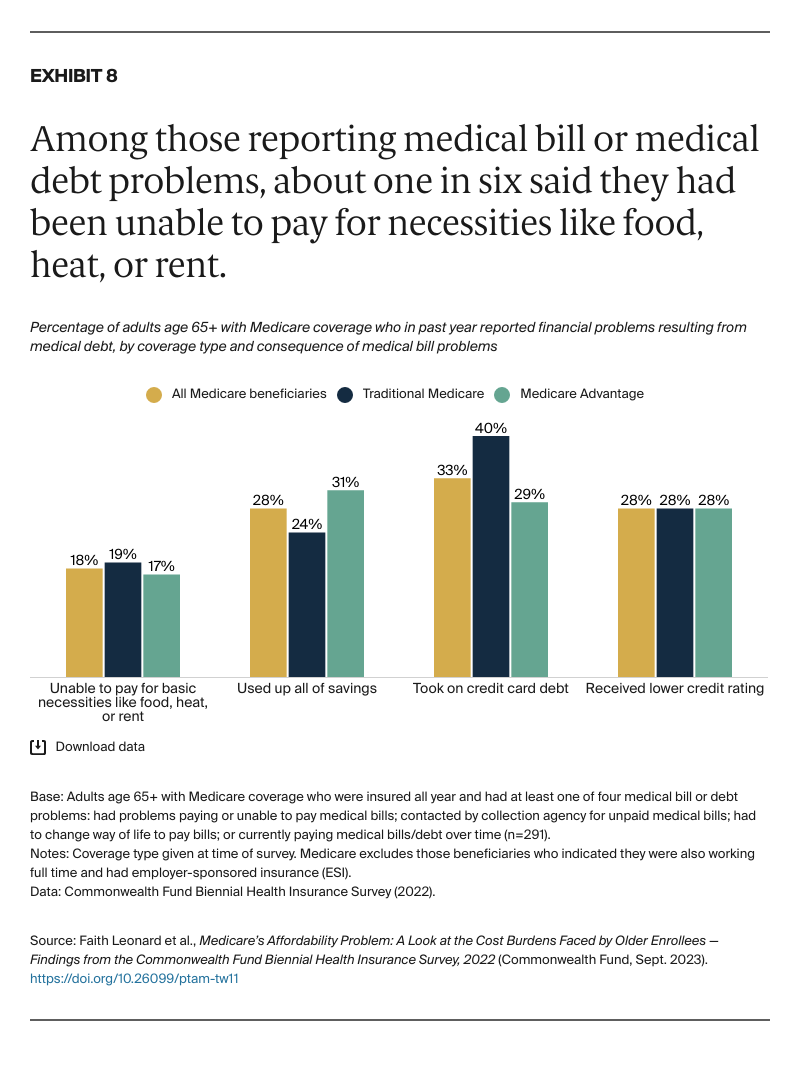

This data brief examines the financial burden of care that people age 65 and older with Medicare face, and how that burden differs for people with traditional Medicare and Medicare Advantage. Using data from the Commonwealth Fund’s 2022 Biennial Health Insurance Survey, we examine the extent to which beneficiaries are underinsured with high out-of-pocket costs or deductibles relative to their income; are experiencing cost-related barriers to receiving care; have problems paying medical bills; and have difficulty paying Medicare premiums.

For the survey, SSRS interviewed a nationally representative sample of 8,022 adults age 19 and older between March 28 and July 4, 2022. This analysis focuses on 1,604 respondents age 65 and older who indicated they were enrolled in Medicare; it excludes individuals who were employed full time and had employer-sponsored insurance at the time of the survey and those who reported being uninsured at any time in the past 12 months. Where sample sizes are sufficient, we separate findings for older adults with traditional Medicare and supplemental coverage and those without supplemental coverage. To learn more about the survey, see “How We Conducted This Survey.”