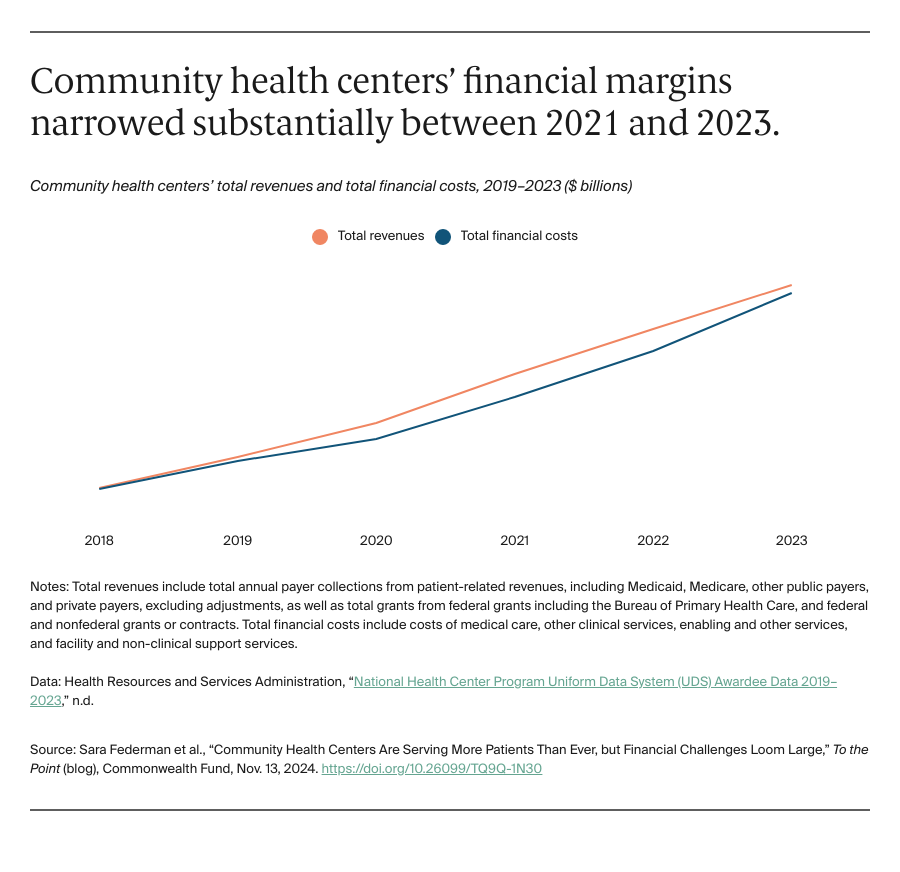

Community health centers (CHCs) are providing high-quality, comprehensive primary care to more patients than ever. In 2023, CHCs served a record-setting 31 million patients, including more than 19 million people with incomes below 200 percent of the federal poverty level (i.e., $29,160 per year for an individual in 2023), 5.6 million people without insurance, and 9.7 million people living in rural areas. As a result, CHCs’ costs are rising — but their funding and revenues haven’t kept pace.

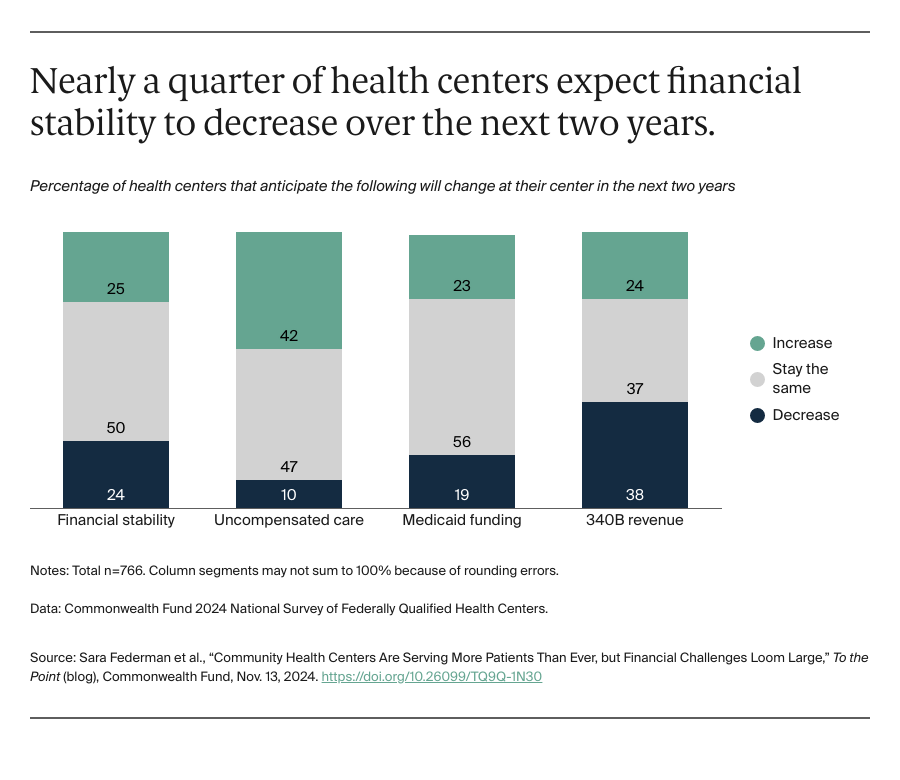

To better understand their financial pressures, we analyzed data from the Commonwealth Fund 2024 Survey of Federally Qualified Health Centers, as well as new national community health center data. We found that CHCs have been experiencing financial challenges for several years, with some concerned their financial stability will worsen over the next two years.

Community Health Centers Face Mounting Financial Challenges

CHCs are funded through various revenue sources, including insurance reimbursements, federal grants and appropriations, and revenue from the 340B program, which allows safety-net providers to purchase drugs at discounted rates and use the savings to cover other services. Half of CHC patients are covered by Medicaid and these reimbursements make up CHCs’ largest revenue source. Another significant portion of CHC patients (nearly 18% in 2023) are uninsured; CHCs depend on federal grants to cover the cost of providing uncompensated care.

Across sources, CHCs face threats that impact their financial stability. For years, relatively low Medicaid reimbursement rates and stagnant federal funding have forced CHCs to operate on thin margins. More recently, declining Medicaid enrollment caused by nationwide Medicaid eligibility redeterminations, the expiration of temporary COVID-era federal funding, and restrictions from drug manufacturers on 340B discounts have exacerbated CHCs’ financial challenges. CHCs are also grappling with uncertainty over the timing and generosity of future federal investments. The Community Health Center Fund, which provides 70 percent of CHCs’ federal funding, is set to expire at the end of 2024.