Introduction

As the Medicare program nears 60 years old, enrollment in traditional Medicare and Medicare Advantage, or MA, is about evenly split.1 As policymakers chart Medicare’s future, it’s important to understand the value people receive from their coverage under the two coverage options. In this data brief, we present findings from the Commonwealth Fund 2024 Value of Medicare Survey to compare the experiences of beneficiaries with traditional Medicare to those with Medicare Advantage.

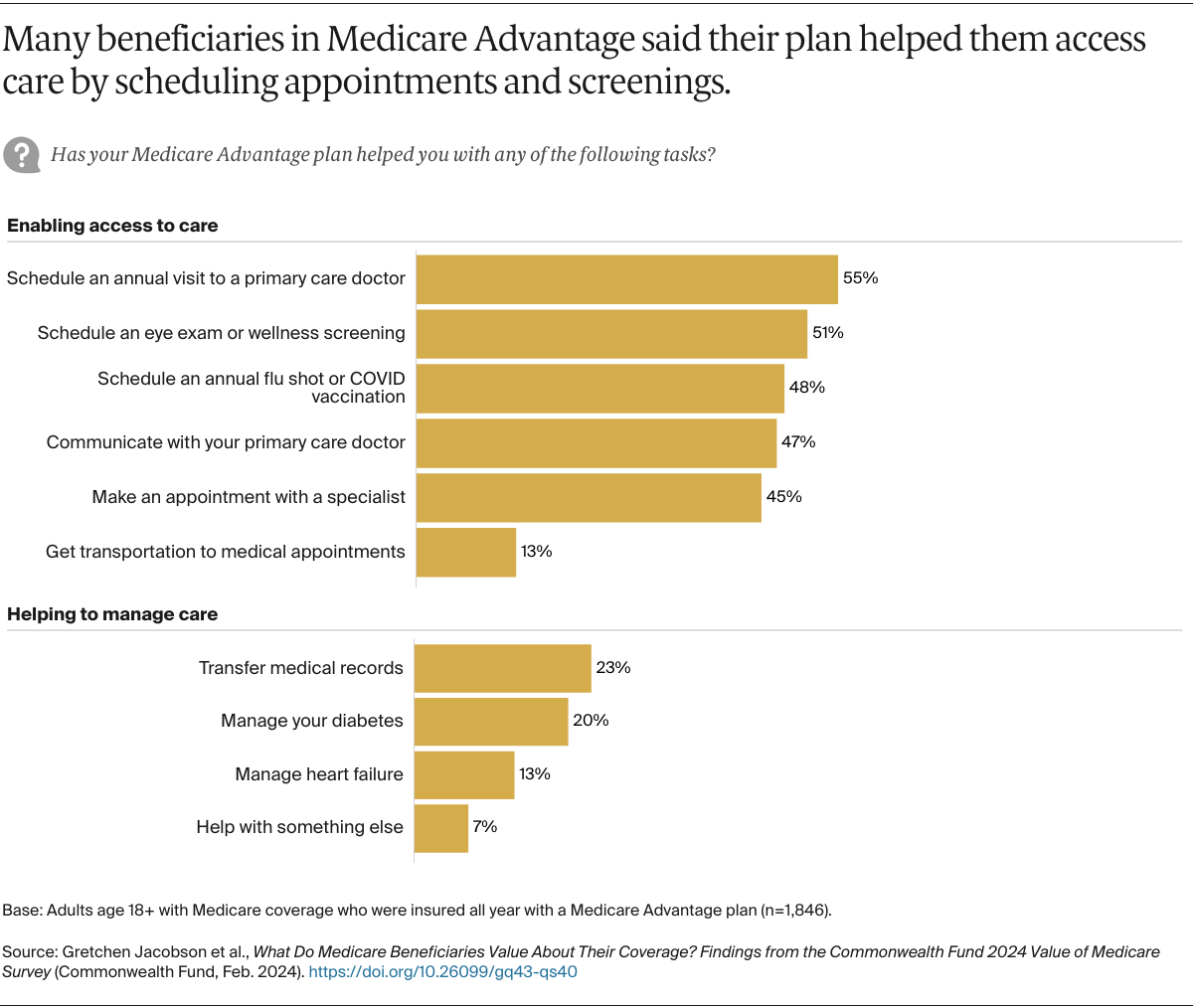

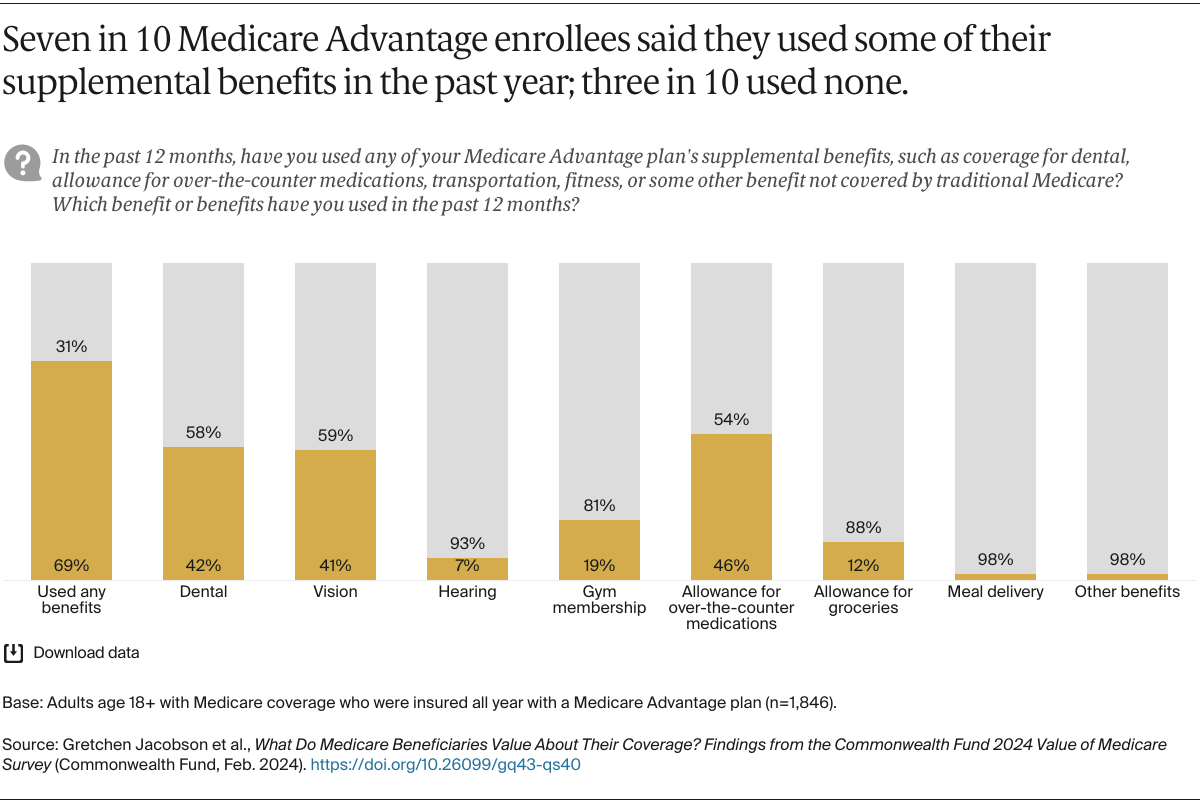

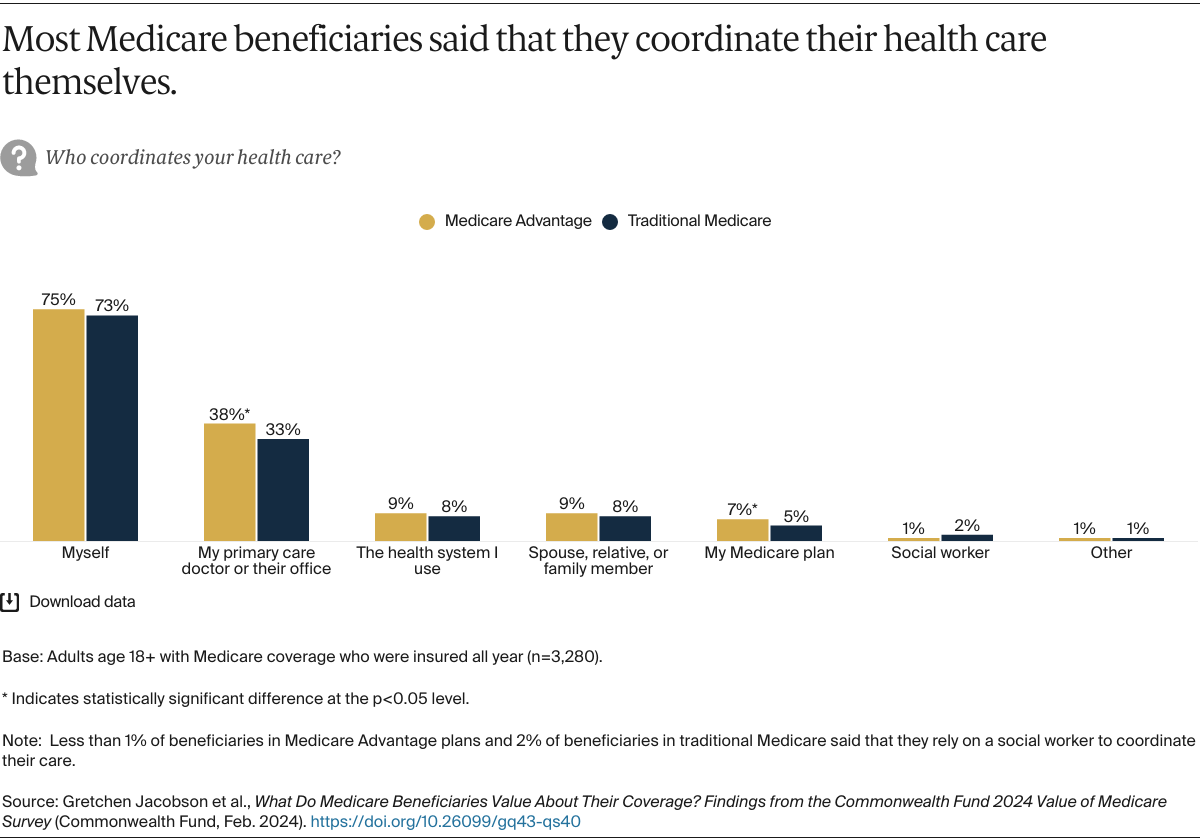

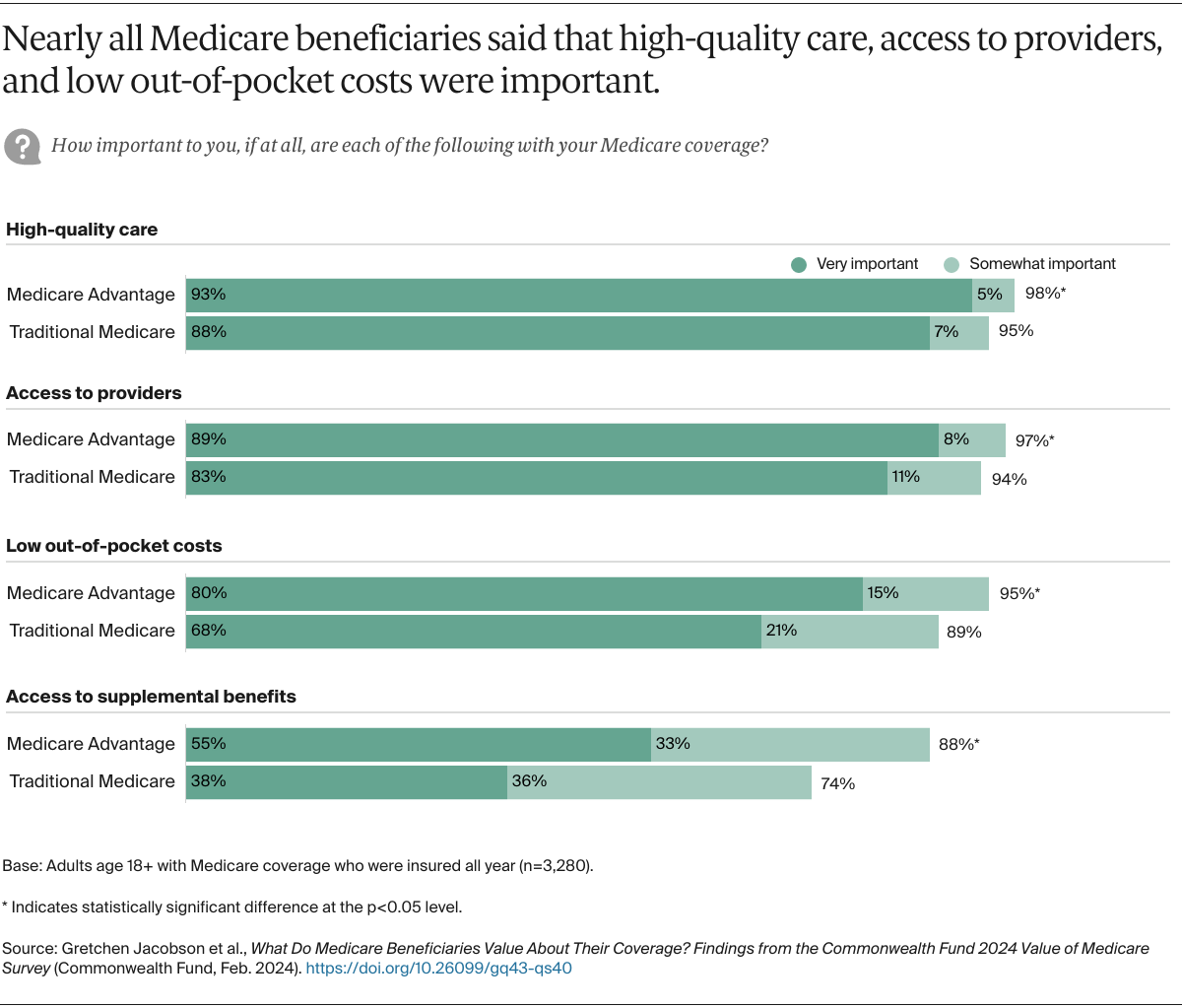

Most analyses have found that the federal government has always paid MA plans more than what it would cost to cover similar people in traditional Medicare. Although estimates vary, one study finds that plans were overpaid by more than $27 billion in 2023.2 These overpayments have raised questions about whether MA enrollees receive greater value that merits the extra cost to Medicare. MA plans typically provide benefits not covered by traditional Medicare, such as some coverage for vision, hearing, or dental services, and they can help to coordinate enrollees’ care. They also limit enrollees’ out-of-pocket costs for Medicare-covered benefits. Traditional Medicare, meanwhile, allows beneficiaries to see any provider without the need to obtain prior authorization or a referral — which MA plans often require — and offers a larger selection of Part D plans for prescription drug coverage. The net effect of these trade-offs has been an important question for both beneficiaries and policymakers.

The Commonwealth Fund survey, conducted in collaboration with SSRS between November 6, 2023, and January 4, 2024, asked a nationally representative sample of 3,280 Medicare beneficiaries age 18 and older about the value of their care as measured by access to benefits, services, providers, care coordination, and satisfaction (affordability of care was not a primary focus, as recent studies have probed this topic extensively). We also took a closer look at the experiences of beneficiaries with greater health care needs. An additional battery of questions was asked only of beneficiaries in MA plans, since they were not relevant to beneficiaries in traditional Medicare. For further detail, see “How We Conducted This Survey.”

Survey Highlights

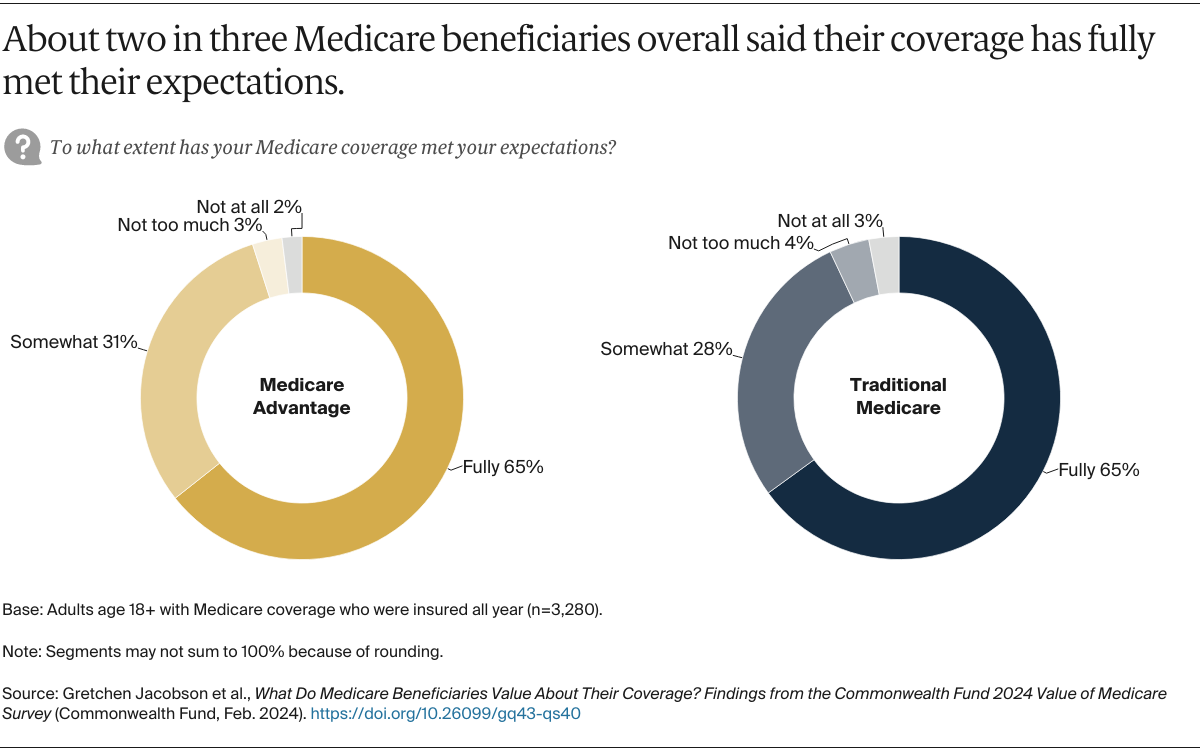

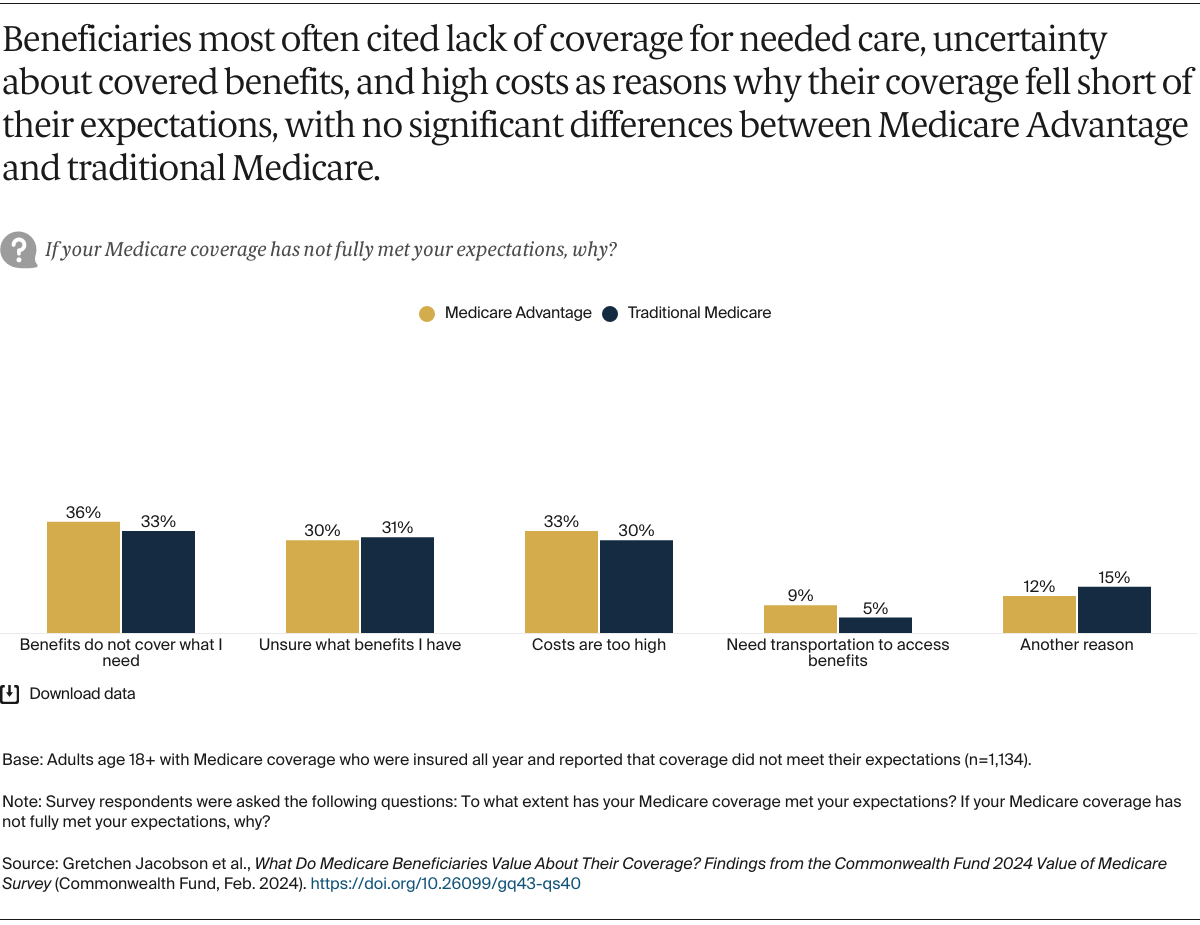

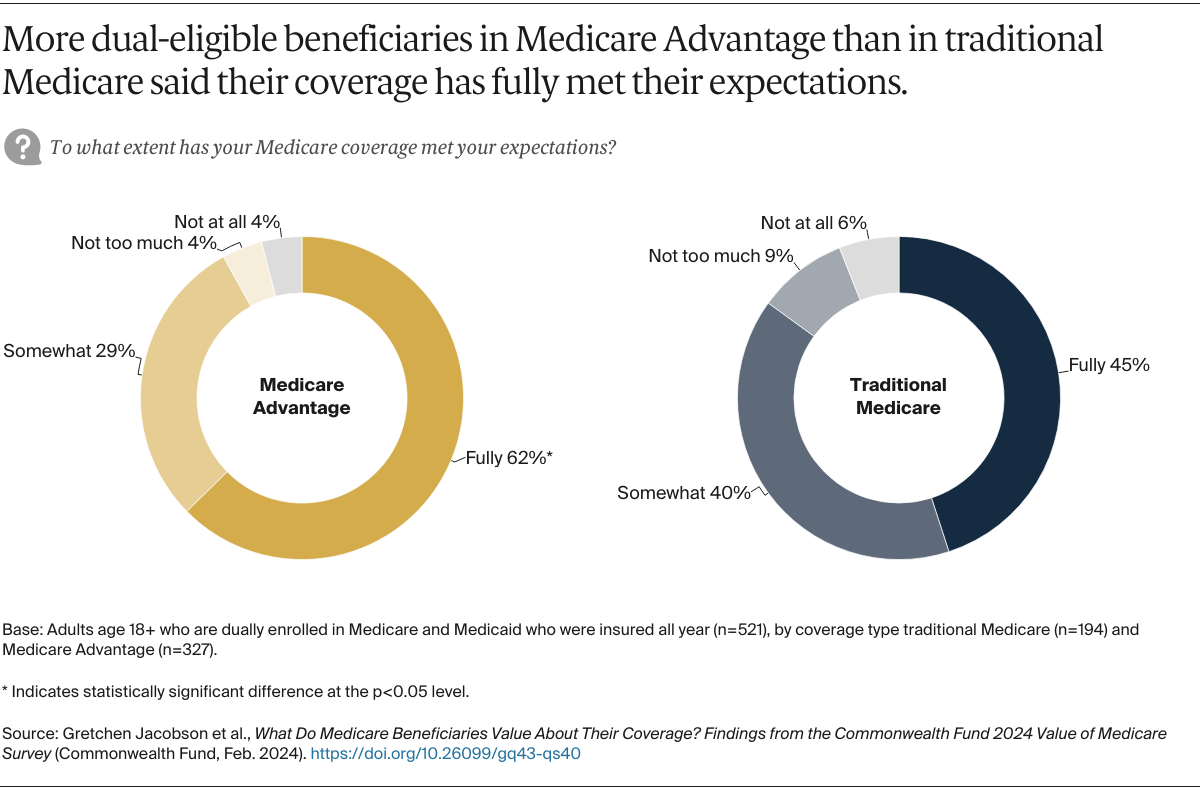

- Whether enrolled in Medicare Advantage or traditional Medicare, about two in three beneficiaries overall said their coverage has fully met their expectations. Those who said it fell short of expectations pointed to a lack of coverage for needed services, high costs, or uncertainty about what benefits are covered.

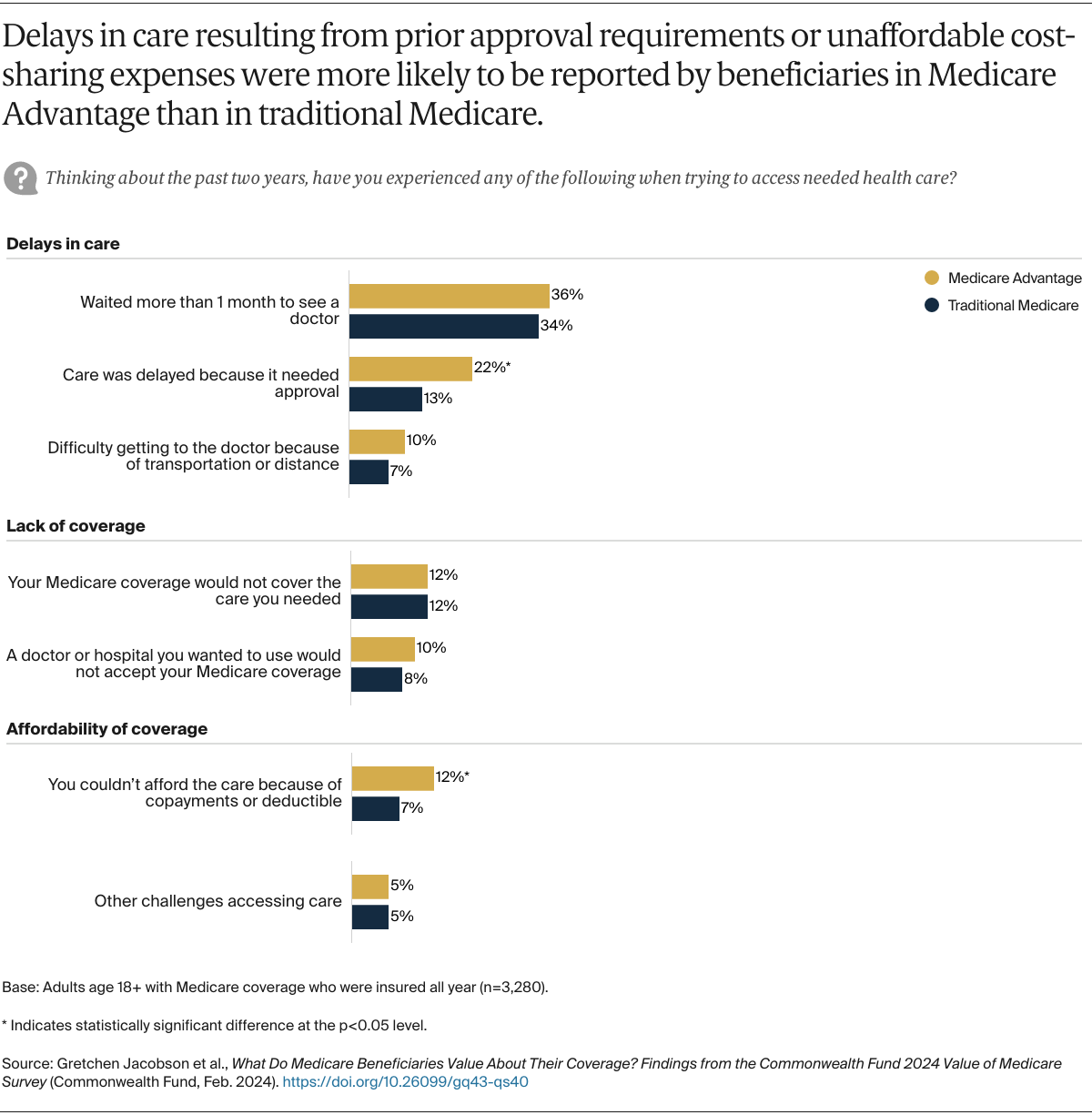

- Larger shares of beneficiaries in MA plans than in traditional Medicare reported they experienced delays in getting care because of the need to obtain prior approval (22% vs. 13%) and couldn’t afford care because of copayments or deductibles (12% vs. 7%). By other metrics, access to needed health care was similar. For example, more than a third of beneficiaries in each type of Medicare coverage said they had to wait over a month to see a doctor.

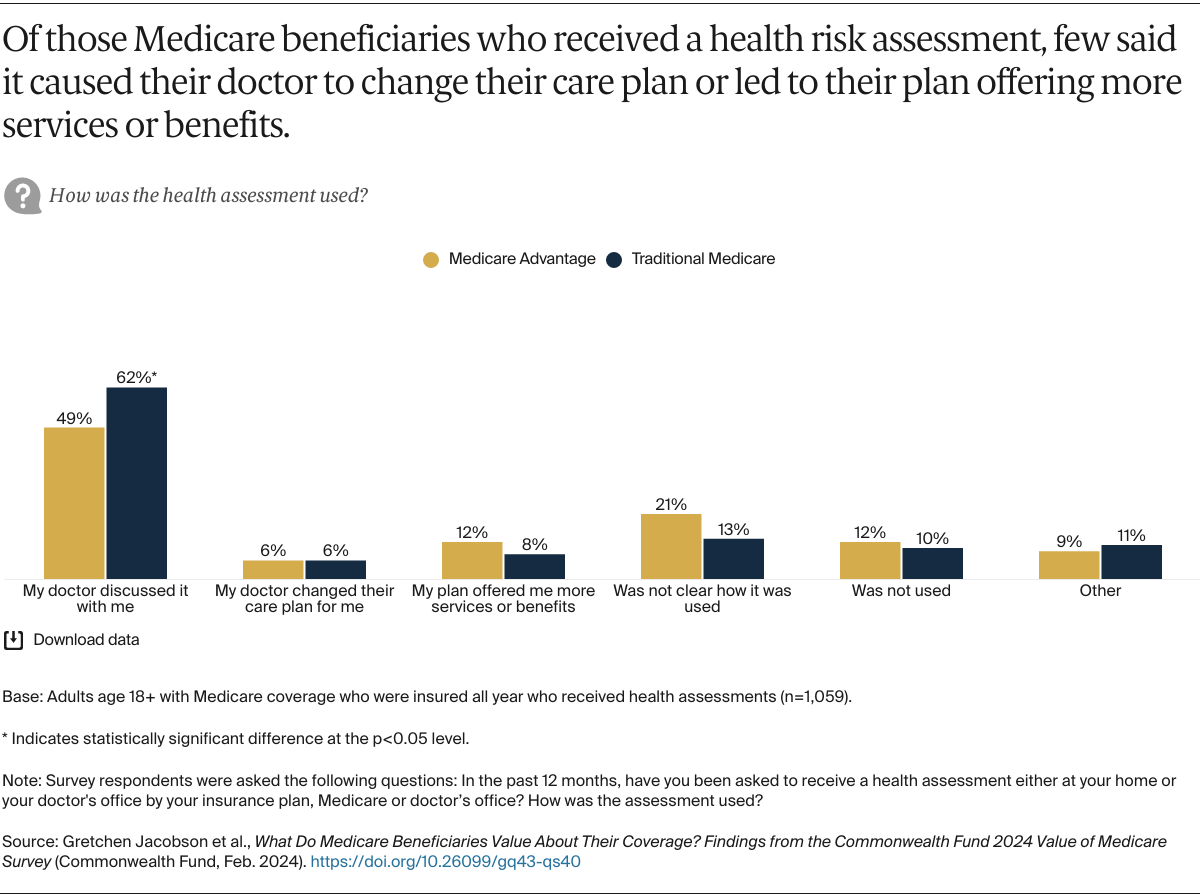

- Three in five beneficiaries in MA plans and one-quarter in traditional Medicare said they were asked to undergo a health assessment, which most frequently resulted in a discussion with their doctor. Few said it resulted in any changes to their care plan or in more services or benefits being offered.

- Seven in 10 beneficiaries in MA said they used some of their plan’s supplemental benefits in the past year; three in 10 did not use any. Four in 10 reported using their dental or vision benefits or an allowance for over-the-counter medications.