Several bills introduced in Congress over the past year seek to make health care more accessible to all Americans while also tamping down growing health care costs. In particular, “Medicare for All” proposals have garnered a lot of recent attention.

How would these proposals change the way Americans get health care? On this episode of The Dose, Shanoor Seervai sits down with the Commonwealth Fund’s Sara Collins to break down the different options policymakers are weighing as they try to reform our health care system.

Transcript

SARA COLLINS: Two types of problems are of greatest concern to Americans right now: high cost of health care and covering the uninsured, which there are 30 million people who are still uninsured. And these concerns were very important in the outcome of the 2018 midterm elections. And Democrats have answered these concerns that we’re hearing in the public with a range of proposals to expand health insurance coverage. With a whole host of bills that all aim to reduce the number of uninsured, improve affordability, lower the rate of health care cost growth. And Medicare-for-All bills are among those bills and have gotten the most attention.

SHANOOR SEERVAI: Hi, everyone. Welcome to The Dose. You just heard from Sara Collins. Sara is vice president for Coverage and Access at the Commonwealth Fund. And Sara recently testified in front of the U.S. House of Representatives Committee on Rules about Medicare for All. Sara, welcome to the show.

SARA COLLINS: Thank you.

SHANOOR SEERVAI: To get us started, tell me a little bit about what happened at this hearing. I’ve heard it was quite momentous.

SARA COLLINS: Well, the focus of the hearing was Congresswoman Jayapal’s Medicare for All Act of 2019. But there was also a lot of discussion about other Medicare-for-All bills, and single-payer approaches to expanding coverage in general. It was a very long hearing — about five hours or more.

SHANOOR SEERVAI: Wow.

SARA COLLINS: Very civil and substantive discussion in a bipartisan way, with good questions from everyone. Seven witnesses, including Ady Barkan, who is a 35-year-old organizer who was diagnosed with ALS, which is a rare and noncurable disease, about three years ago. And he gave incredibly compelling testimony in the hearing. He was using a computer because he’s lost the ability to speak.

SHANOOR SEERVAI: Should we listen to a short clip of what he said?

SARA COLLINS: Sure.

Ady Barkan: Every family is eventually confronted with serious illness or accidents. On the day we are born and on the day we die, and on so many days in between, all of us need medical care. And yet in this country, the wealthiest in the history of human civilization, we do not have an effective or fair or rational system for delivering that care. I will not belabor the point because you and your constituents are well aware of the problems: high costs, bad outcomes, mind-boggling bureaucracy, racial disparities, bankruptcies, geographic inequities, and obscene profiteering.

The ugly truth is this. Health care is not treated as a human right in the United States of America. This fact is outrageous, and it is far past time that we change it. Say it loud for the people in the back — health care is a human right.

SHANOOR SEERVAI: Ady’s testimony goes on. And one of the things he says is that we need smart Congressional action on health care. So is this public sentiment, this need for change, why we just had the first hearing on Medicare for All?

SARA COLLINS: It wasn’t the first hearing. There have been prior hearings several years ago on Medicare for All. It’s always been kind of in the mix of things that policymakers have been interested in moving forward on.

Democrats over the past year or so have introduced 10 to 11 bills, all of which would improve health insurance coverage, improve affordability, and lower the rate of health care cost growth.

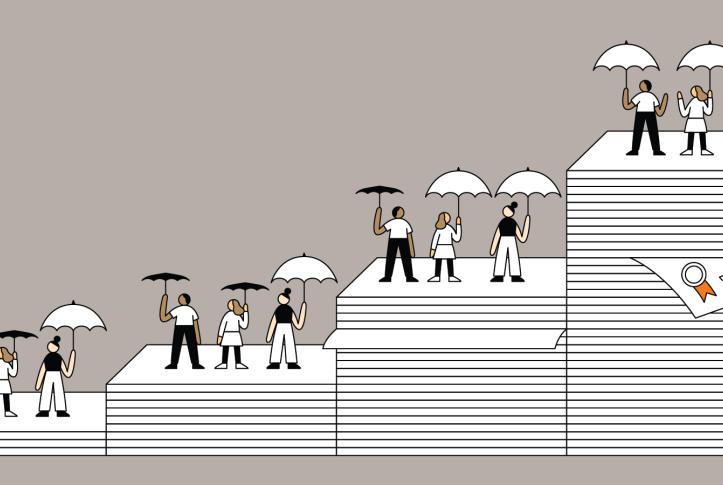

And they really fall on a continuum, I think, with Medicare for All at one end of that spectrum. But organized into three broad categories — I like to think of them as bills that would add more public plan features to private insurance, bills that would add public plan options into the marketplaces based on Medicare or Medicaid, or even extending that option to people on employer plans. And then bills that make public plans the primary source of coverage, which are the Medicare for All and single-payer type bills.

SHANOOR SEERVAI: And so what is the problem that each of these different approaches is trying to solve?

SARA COLLINS: So the Affordable Care Act brought truly sweeping change to the health system, expanded comprehensive health insurance to millions of Americans, and made it possible for anyone with health problems to get coverage by banning insurers from denying people coverage or charging them more because of preexisting conditions. The number of uninsured has fallen by nearly half since the ACA became law. However, about three distinct yet interrelated problems remain. 30 million people are uninsured. 44 million people have such high out-of-pocket costs relative to their income — they’re underinsured. And health care costs are growing faster than median income in most states.

17 states have yet to expand Medicaid. People who have incomes right over that eligibility threshold for the tax credits to the marketplaces — people who earn about $48,000 a year for an individual, just over $100,000 for a family of four — aren’t eligible for tax credits. That’s where the biggest affordability problems are for people who don’t get coverage through an employer and have to buy coverage on their own.

And then a key thing, and this spreads across the insured population, 158 million people get coverage through an employer. Cost-sharing is rising. So more people are paying higher deductibles. More people are having premiums that comprise a larger and larger share of their incomes.

SHANOOR SEERVAI: Is that a new problem, that cost-sharing is rising?

SARA COLLINS: No, that’s been with us for some time. But what’s happening is that health care costs are rising faster than median income.

SHANOOR SEERVAI: Okay.

SARA COLLINS: And so the share of the premium that employees have to pay hasn’t changed very much over time: it’s about 80 percent or so on average. But premiums are rising. It means that the dollar amount that people are having to pay is rising.

And employers try to manage those premium costs by increasing deductibles. So more people have deductibles, and those deductibles have just grown over time. So when you combine those two costs, premium plus deductibles in employer-based plans comprise about 12 percent of people’s income at this point. In several states, like Mississippi and Louisiana, where incomes are lower than the national average significantly, that combined amount rises as high as 15 percent.

SHANOOR SEERVAI: Wow. We made a lot of gains with the Affordable Care Act, but we still have a problem with people being uninsured. And we still have a problem with people not being able to afford their care, even if they have insurance.

Many of our listeners do know this, but why is it important to help make sure that everyone has coverage and that those with coverage aren’t struggling with costs?

SARA COLLINS: So leaving so many people uninsured and underinsured affects families’ ability to stay healthy and maintain their health over time, and also their financial situation. We know from our survey data that people who are uninsured or underinsured report much higher rates of not being able to pay their medical bills or carry medical debt. We asked in our survey if you were to receive an unexpected bill of $1,000, if they would have the money to pay for that. And about half of people whose incomes are under 250 percent of poverty, in employer-based plans, said no to that question.

SHANOOR SEERVAI: Uh-huh. And probably if you’ve been in a situation where you were faced with a bill that you couldn’t pay, the next time around you might opt to go without that care.

SARA COLLINS: Exactly. So it’s a major factor in why people don’t get health care. So even people who are insured are making decisions like that — just delaying getting care. And that’s not good for people’s health. We don’t want people to be making decisions because of their health plan that run against their health care needs and could damage them and their families long term.

The financial problems are very significant. The other thing really to keep in mind: the Institute of Medicine a long time ago, in 2003, did a seminal report on insurance coverage. And they found that people who don’t have health insurance or adequate health insurance have fundamentally different life experiences. They have lower educational attainment, lower lifetime earnings, lower savings, lower productivity, and lower life expectancy. So this, in terms of the nation overall, we’re really damaging our economic prosperity and the potential for that by leaving so many people that have this precarious access to the health care system.

SHANOOR SEERVAI: Well, it sounds like there’s some movement to try and fix this. So let’s go back to what you named as the three approaches on this continuum of health reform. And let’s get into each approach in a little more detail.

SARA COLLINS: So each of these bills, as I’ve mentioned, have the ability to move us forward. So some have smaller fixes, very needed fixes to the Affordable Care Act, like making health plans more affordable: lifting that threshold where people fall off the cliff, so to speak, and aren’t eligible for tax credits anymore.

SHANOOR SEERVAI: So explain that to me. What’s the cliff, and how do we make it so that people aren’t falling off it?

SARA COLLINS: So if you are eligible for coverage through the marketplaces, and you’re eligible for tax credits — if you don’t have access to an employer-based plan and your income is under $48,000 for an individual — then you’re eligible for a subsidy or a tax credit. People whose incomes are below about $30,000 or so are eligible for subsidies to help with their cost-sharing. But as you move up the income scale, you pay more and more in terms of your premiums and you’re no longer eligible for the subsidies for cost-sharing.

On the premium side, the subsidies through the marketplaces work by capping what you pay for premiums as a share of your income. People pay no more than 10 percent of their income.

So one proposal is simply to lift that cap so there’s no longer a threshold for people. The most that anyone would ever pay, if they have to buy on their own, would be 10 percent of their income. Because it has a natural phase-out, right?

SHANOOR SEERVAI: Uh-huh.

SARA COLLINS: So as your income rises, the amount you pay in premium starts to drop below 10 percent.

SHANOOR SEERVAI: Right.

SARA COLLINS: It would be a very simple fix. It’s been in these recent bills that add more public plan features to private insurance, enhancing the Affordable Care Act’s provisions. But RAND has estimated making that small fix would insure more than two million people.

SHANOOR SEERVAI: Let’s talk about what bills that provide the choice of a public plan along with the choice of a private plan would do.

SARA COLLINS: So the bills that would add a public plan option are varied. You’re not getting a Medicare plan. You’re getting a plan that looks like Medicare. The Secretary of HHS would set premiums for it, pay providers probably closer to Medicare rates, which would lower the costs and the premiums for the plans.

And then another option you’ve probably heard people talking about is buying into Medicare if you’re age 50 or older or 55 or older. But again, the way the bills are structured now, you’re not technically buying into the Medicare program, you’re buying into a plan that’s available on the marketplaces that looks like Medicare. But the idea really is to lower premium costs to make these plans more affordable.

SHANOOR SEERVAI: Okay. Well, let’s talk about the Medicare for All proposals, then.

SARA COLLINS: So the Medicare for All bills are all very similar. Most of them, again, resemble the current Medicare program. But they aren’t the Medicare program that we know today.

They limit or end premiums and cost-sharing. Some plans have some limited cost-sharing for prescription drugs. Most private insurance coverage goes away.

You can still buy supplemental coverage for things that aren’t covered in Medicare for All bills. But because the benefits are so comprehensive people probably wouldn’t really need it. And the approach brings, really, substantial federal leverage to prescription drug negotiation and it brings leverage in setting provider prices closer to Medicare rates.

SHANOOR SEERVAI: Why is it important to get at these two issues, to make prescription drugs more affordable and to bring down what we’re paying providers in private plans?

SARA COLLINS: If you think about people on employer plans having to pay so much out of pocket, what’s important to remember is that the key driver of those trends is the rate of growth in health care costs.

As health care costs rise everybody’s premiums rise, employers raise deductibles to deal with those premiums. And there’s growing evidence that a major cause of the rate of growth in health care costs are the prices that are paid to hospitals, to physicians, to drug companies by private insurers.

SHANOOR SEERVAI: So why are private insurers doing that? Why are they paying so much money for drugs and to providers and hospitals?

SARA COLLINS: If you think about Medicare, how Medicare or a public plan or Medicaid sets prices — they’re set by the federal government.

SHANOOR SEERVAI: Okay.

SARA COLLINS: And everybody knows what those prices are. There’s a lot of transparency about how those are set. What happens in the private market is insurers will negotiate prices with hospitals, for example, or physicians that they want to be in their network. But those negotiations are private. Providers that don’t have much competition, so maybe one hospital, has a lot of leverage in setting the prices with the carrier. And the insurer wants that hospital, or those hospitals, in their network. And so they’re willing to make concessions on price in order to guarantee that they’ve got that hospital in their network. And those costs, in turn, are transferred to their employees.

Employees have to pay part of the premium, but they also have to make wage concessions. You think about your overall compensation package: the larger and larger the premium is, the more expensive your health insurance coverage is, so you’re not going to get in the wage increases that you might have otherwise gotten because of the premium increases.

And employers are trying to grapple with this higher premium by increasing the cost-sharing and the deductibles. So even with these wage concessions, employees are getting a lower-value product. So they’re paying both higher premiums, they’re not getting the wage increases that they might have gotten otherwise, and they’re getting a product that leaves them exposed to high out-of-pocket costs, potentially, if they have a sickness. What’s important to remember is the storyline of where the price begins, it begins in these private negotiations.

SHANOOR SEERVAI: Right.

SARA COLLINS: So if we want to improve affordability, we have to address the negotiation that’s happening with the private insurer and the provider.

SHANOOR SEERVAI: And that negotiation is happening behind closed doors. And we end up, then, with prices that are artificially high. Surely this is not the case in other countries, where everybody has health coverage?

SARA COLLINS: Exactly. There’s much more government regulation over the prices paid. And consequently, other countries have much lower overall health spending than the United States does. And there’s lots of research that suggests that the prices paid to private providers in the United States are the main reason for that spending gap.

SHANOOR SEERVAI: So would Medicare for All, if it were to set prices for providers closer to what Medicare does than what the private plans are doing — would that actually make health care less expensive?

SARA COLLINS: The estimates of a Medicare for All approach range from a decline of 10 percent in national health spending to an increase of about 17 percent. And so there are three major sources of those cost savings.

One is lower provider prices. The other source of savings is administrative costs. I think the administrative costs in private coverage right now are about 14 percent of spending. And the Medicare for All approach would lower them from anywhere from 6 percent to 3-1/2 percent of overall spending. The other source of saving is allowing the Secretary of HHS to negotiate prescription drug prices.

There’s a range of estimates. And we’ve seen a lot of the discussion about how much this would cost the United States. It’s not that the spending is out of control, it’s the source of payment that shifts significantly under these plans. So most of the responsibility for paying those health care costs shifts from people, from households and employers, state and local governments, to the federal government. So all of a sudden, the payer of all that spending is the federal government. And that’s what people have really latched onto.

I mean some of the estimates show somewhat higher spending. You’re bringing 30 million more people into the system.

SHANOOR SEERVAI: Right.

SARA COLLINS: 44 million right now are estimated to be underinsured. You’re eliminating all their cost-sharing. So that’s going to push up —

SHANOOR SEERVAI: Right.

SARA COLLINS: — spending, which is what you want. That’s the point of this. You want people to get health care.

SHANOOR SEERVAI: Right.

SARA COLLINS: So there’s some savings, but there are also going to be some new taxes. But what those taxes replace are costs that are somewhat hidden to many people right now. If you’re on an employer-based plan, some people are very aware of the amount they spend on premiums. But a lot of people don’t know. It just comes out of their paycheck.

SHANOOR SEERVAI: Right.

SARA COLLINS: And so all of a sudden, that cost becomes very visible, because they would pay higher taxes. But the incidence of that tax would be very different across the population, right? We have a progressive income tax.

SHANOOR SEERVAI: Right.

SARA COLLINS: So some people’s taxes would go up more than others. So it’s possible for people who are earning less money that they would actually see a net decline in their health care costs.

SHANOOR SEERVAI: As we start to wrap up, we have growing evidence that health care costs really need to be brought under control. And the Medicare for All bills offer one way to do that, would you say?

SARA COLLINS: They do. But you wouldn’t need a Medicare for All bill to achieve some of these savings. So you could, you know, pay providers at lower rates. Make some savings in administration. Those bills would also allow the Secretary to negotiate drug prices.

SHANOOR SEERVAI: Or there would be the approach of lifting that threshold on being eligible for subsidies — the 400-percent-of-income threshold.

SARA COLLINS: There are bills in Congress that do that. It’s a very simple fix — not cost the federal government very much money at all, and really help a lot of people.

So there’s lot of ideas. Another way is, for example, could you take a public plan option and launch it in one state and test how that goes? There’s a lot of experimentation that can also be done without having to shift fully to a single-payer plan.

SHANOOR SEERVAI: Uh-huh. And you put this really beautifully in your testimony. So I want to ask you, what are the advantages of doing a full overhaul, like having Medicare for All? And then what are the advantages of doing some of the more incremental fixes we’ve talked about, or piloting a public plan, for example, in just one state?

SARA COLLINS: You know, all of those ideas move us ahead. And right now, we desperately need to move forward. We need to help people even in very small ways, like lifting the tax credit for eligibility would help so many people. But there are trade-offs in doing it that way, as well. People who are advocating for Medicare for All bills like the idea that it would just be done in one fell swoop, and we could move to the system of universal coverage and probably lower prices much more quickly. The recent experience with the Affordable Care Act suggests that there are trade-offs in doing it in an incremental way, because sometimes it takes a really long time for things to move forward. And we haven’t seen any legislation in the nine years since the passage of the Affordable Care Act that would improve coverage for people.

SHANOOR SEERVAI: So it sounds like we have a lot of good options on the table, and we have to wait and see which one catches?

SARA COLLINS: There will be many hearings, hopefully. This was one of the first ones on improving coverage that we’ve seen in a long time. And that’s what you want. You want an airing of what the trade-offs are between Medicare for All or smaller fixes. And that’s good for the public to listen and to think about different options.

SHANOOR SEERVAI: All right. Thanks so much for joining me today, Sara.

SARA COLLINS: Thank you for having me.