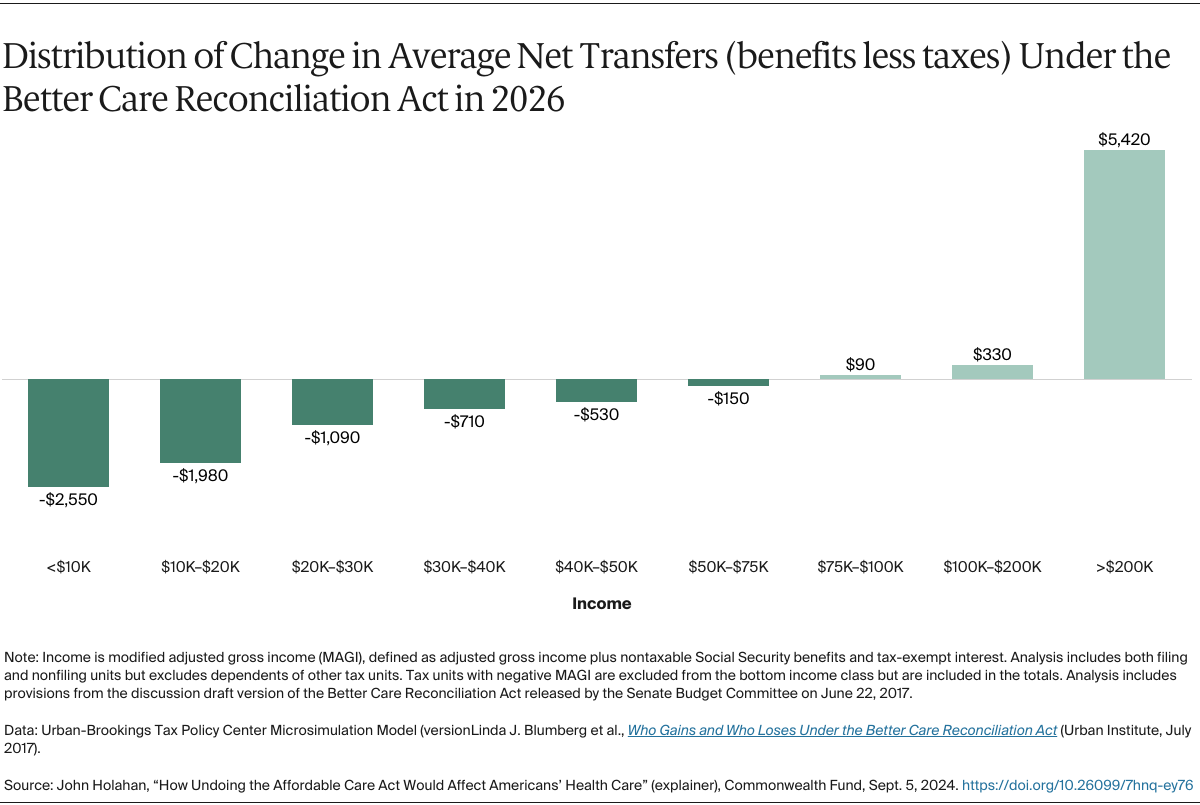

Pending the outcome of the 2024 presidential and congressional elections, the fate of the Affordable Care Act, or ACA, may hang in the balance. Republican presidential nominee Donald J. Trump has a history of calling for the repeal of the ACA, which he has described in the past as a “disaster.” Several repeal proposals were introduced in 2016 and 2017 during his administration, though none were enacted into law — largely because Democrats were uniformly opposed, as were some Republicans.

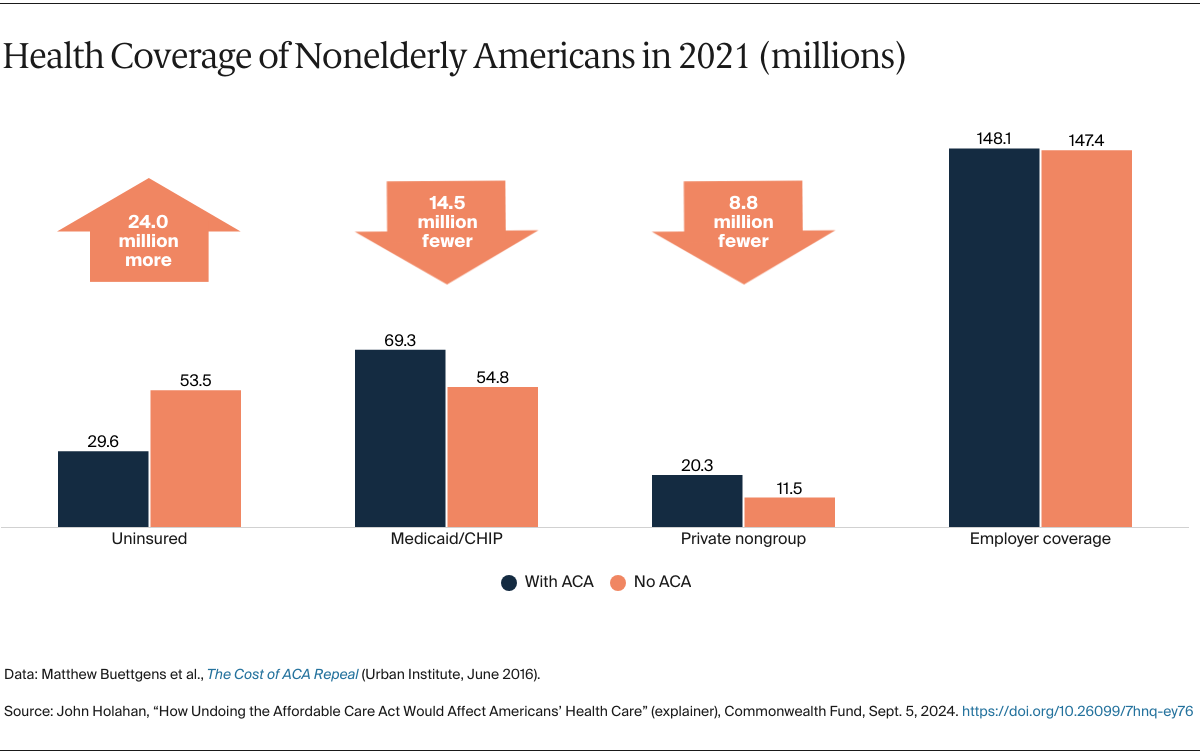

Enacted in 2010 and expanded in 2014, the ACA has largely been successful in its primary goal of expanding access to affordable, comprehensive health insurance coverage, particularly among Americans with low and moderate income. The law has achieved historic reductions in the nation’s uninsured rate in three key ways:

- Allowing more people to enroll in Medicaid, the public health insurance program, by expanding income eligibility standards.

- Making income-based subsidies available for the purchase of nongroup, or individual, market coverage through new insurance exchanges called marketplaces.

- Introducing a number of reforms to the private insurance market, among them: a ban on insurers denying coverage to people with preexisting health conditions; guaranteed issue, or the requirement that health plans accept applicants regardless of age, health status, gender, and other characteristics; modified community rating (meaning insurers cannot vary rates based on health status); and the requirement that plans cover important preventive health services, like cancer screenings, at no cost to consumers.