Medicare Advantage offers Medicare benefits through private insurance plans, as an alternative to traditional Medicare. The federal Centers for Medicare and Medicaid Services (CMS), the agency that runs Medicare, pays these private plans on a capitated basis — a per person, per month rate to cover health care services for each enrollee.

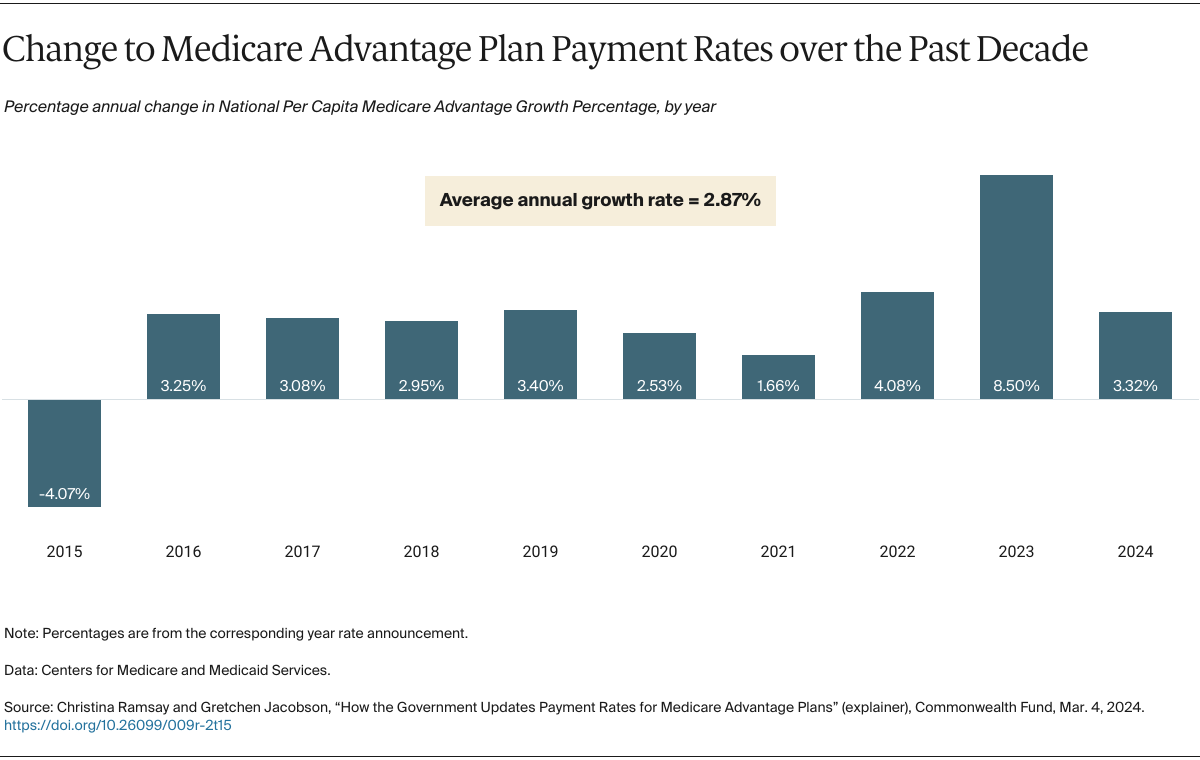

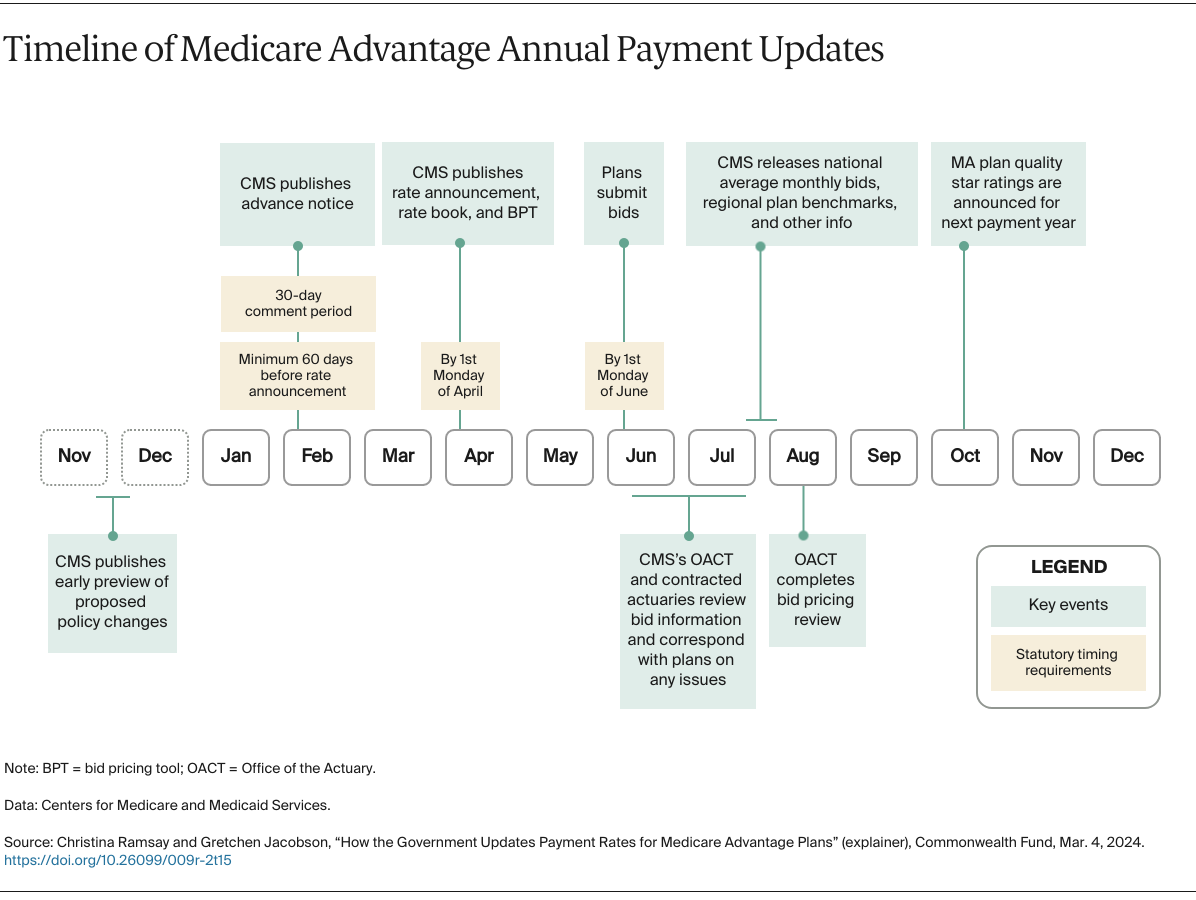

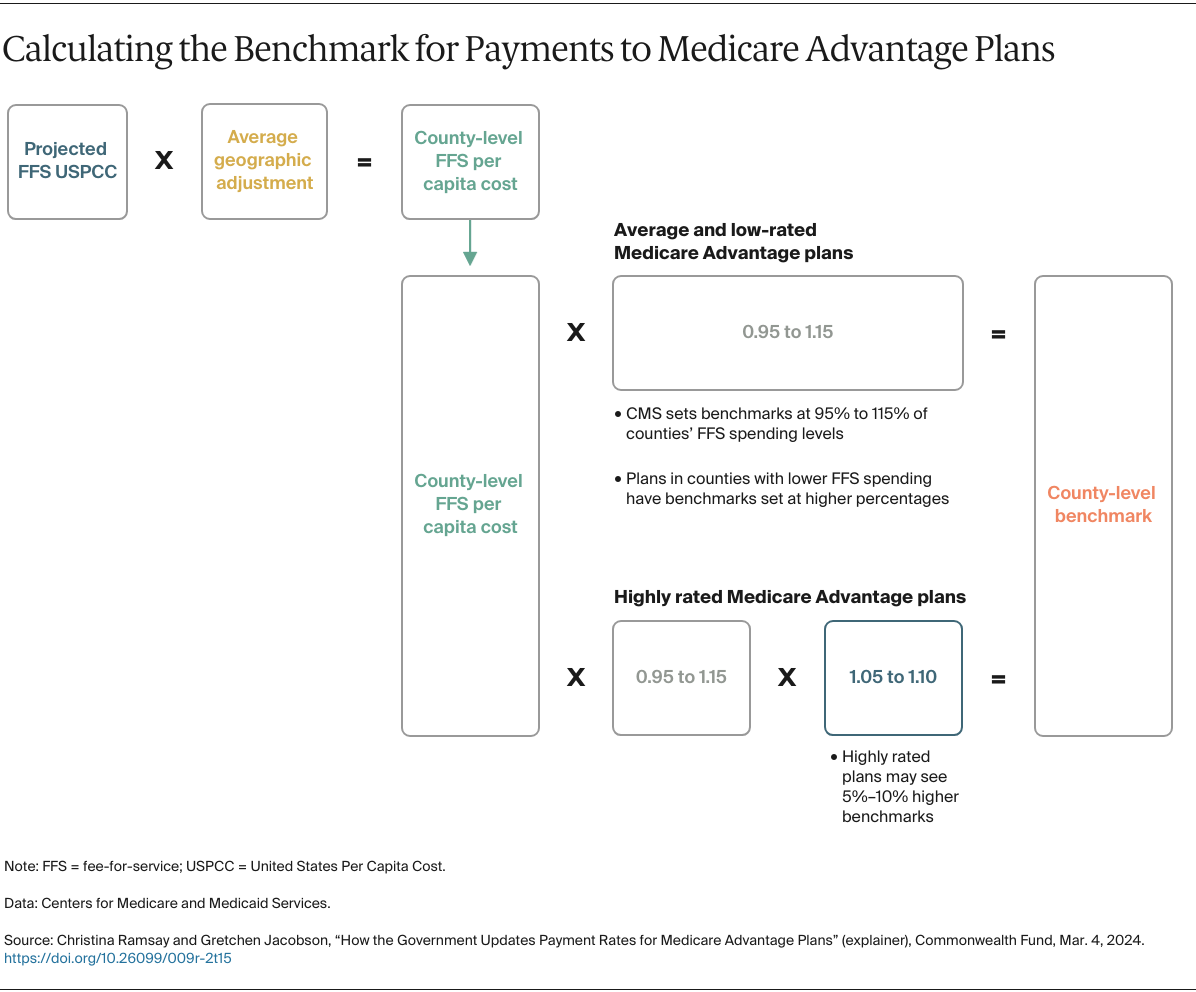

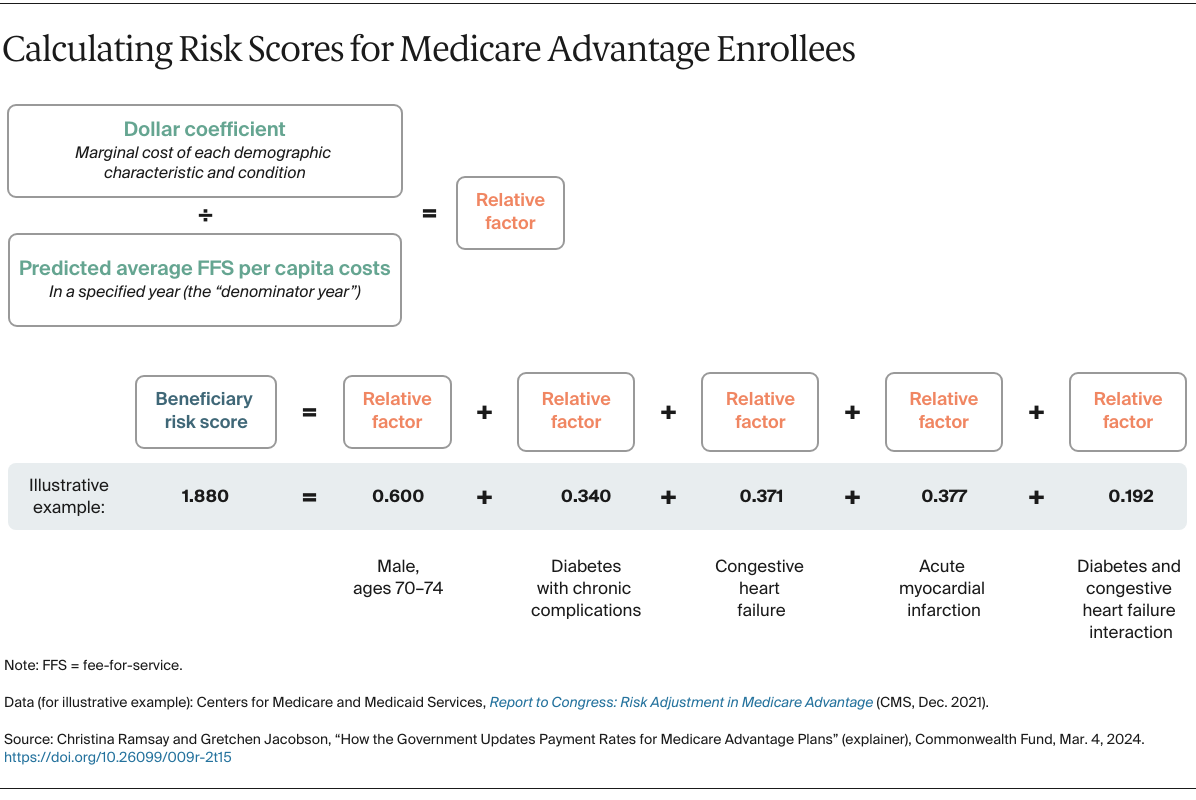

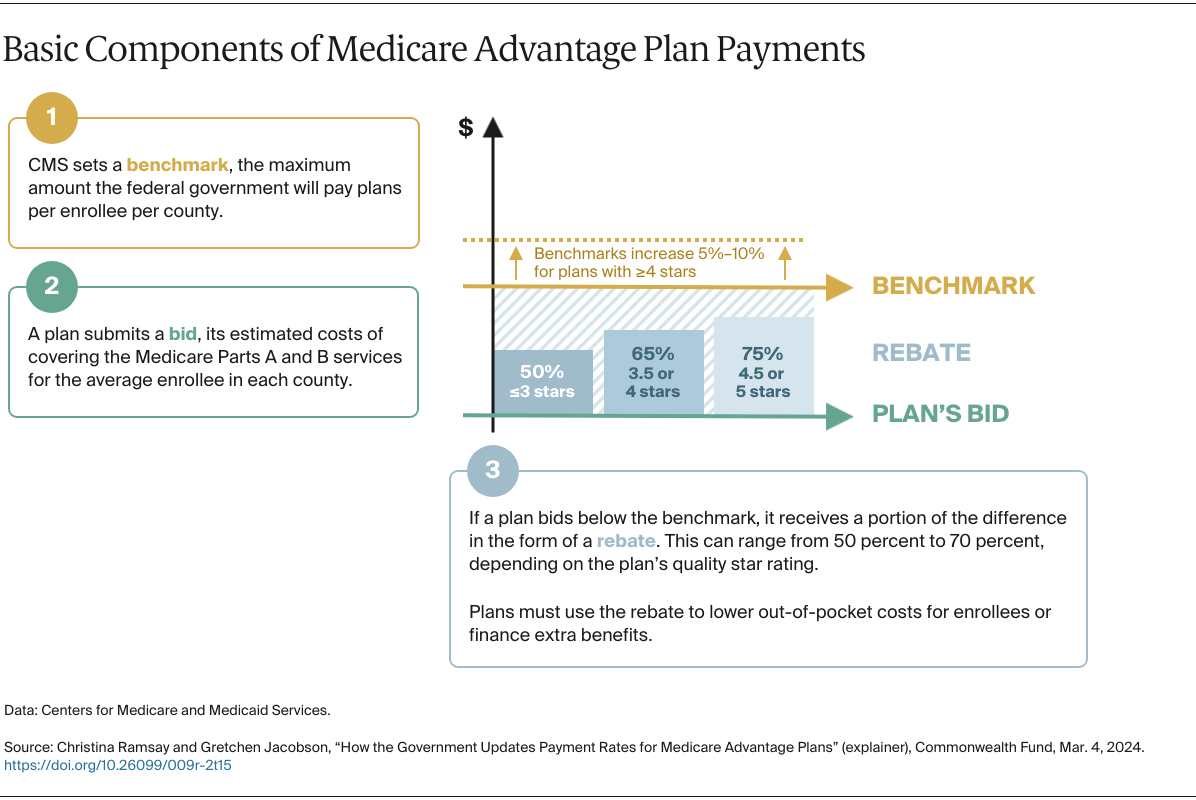

Every year, CMS is statutorily required to update how much Medicare Advantage plans are paid to cover their enrollees. The rates are revised upward or downward, largely driven by how CMS updates two things: 1) the benchmark, or the maximum amount the federal government will pay plans for an average person in each county, and 2) the risk adjustment model, which CMS uses to modify payments based on enrollees’ expected health care costs.

In addition to being complex, the payment update process can be controversial. CMS’s methodological changes affect plan revenue, and plans sometimes argue that certain updates will jeopardize their ability to deliver stable, affordable benefits. Some changes can invite substantial pushback; for example, in response to objections raised by insurers and providers, last year’s proposed revisions to Medicare Advantage’s risk adjustment model will be phased in over three years.

Accurate payments to Medicare Advantage plans help ensure these plans can meet patients’ health needs while making efficient use of taxpayer dollars. About half of all Medicare beneficiaries are now enrolled in Medicare Advantage. As enrollment in these plans continues to grow, how they are paid — and how much —will be central to the debate over the efficiency and sustainability of Medicare spending.

This explainer lays out the steps CMS follows when updating annual payment rates for Medicare’s private plans. To learn the fundamentals of Medicare Advantage, how it compares to traditional Medicare, and how plans are paid, see our primer.