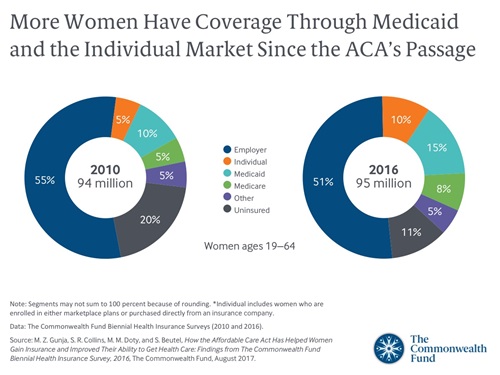

New York, NY, August 10, 2017 — Since the Affordable Care Act (ACA) took effect in 2010, the number of uninsured women ages 19 to 64 decreased by nearly half, from 20 percent (19 million) in 2010 to 11 percent (11 million) in 2016, according to a new Commonwealth Fund report. Among low-income women earning less than $48,600 for a family four, the uninsured rate fell from 34 percent in 2010 to 18 percent in 2016.

The report, How the Affordable Care Act Has Helped Women Gain Insurance and Improved their Ability to Get Health Care, uses findings from the Commonwealth Fund’s Biennial Health Insurance Survey to compare women’s health coverage and health care in the years before and after the ACA’s major coverage expansions. The study finds that the law’s insurance market reforms, such as requiring plans to include maternity coverage, not charging women more because of their gender, and expanding Medicaid eligibility vastly improved health care access and coverage for U.S. women. In 2010, just 5 percent of working-age women had coverage through the individual market and 10 percent were insured through Medicaid. By 2016, the share of women with individual coverage had doubled (10%) and the share with Medicaid climbed to 15 percent.

“Before the Affordable Care Act, it was extremely difficult for women not covered through an employer to buy health insurance,” said Sara Collins, Vice President for Health Care Coverage and Access at the Commonwealth Fund and the report’s coauthor. “This report finds that the ACA’s health insurance market reforms and coverage expansions have enabled millions of women to gain comprehensive insurance with free access to preventive care services critical to their health.”

According to the report, in 2016 more than two-thirds (67%) of women who had shopped for health insurance on their own in the prior three years ended up enrolling in a plan. This is a substantial increase from 2010, when fewer than half (46%) of women who looked for plans on their own enrolled in one. Moreover, the share of women reporting that they had difficulty finding an affordable individual plan fell by nearly half — from 60 percent in 2010 to 36 percent in 2016.

A previous study found that one-third of women who tried to buy an individual health plan from 2007 to 2010 had either been turned down by an insurance company, charged a higher premium because of their health, or had a specific health problem that was excluded from their plan. Among women with chronic illnesses, nearly half (46%) reported these problems.

Additional key findings from the new report include:

- Fewer women skip needed care: In 2010, nearly half (48%) of U.S. women (about 45 million) reported that they did not fill a prescription for medicine, visit a doctor when sick, or receive recommended care in the past year because of the expense. By 2016, the share of women reporting financial barriers to needed care had fallen to 38 percent.

- Medical bill problems declined: In 2012, 47 percent of women (44 million), reported they had trouble paying medical bills in the past year, were contacted by a collection agency about unpaid medical bills, had to change their way of life to pay them, or were carrying medical debt. In 2016, the share of women with medical bill or debt problems declined modestly, to 42 percent. But there was an uptick that year in the share of women who reported they were paying off medical debt.

- Higher rates of preventive care among insured women: 72 percent of women ages 40 to 64 who were continuously insured in 2016 had a mammogram within the past two years, versus 40 percent of uninsured women in this group. Research shows that increasing the breast cancer screening rate for women above age 40 to 90 percent could save 3,700 lives annually.

“This report describes substantial progress for women since the Affordable Care Act was passed,” said Commonwealth Fund President David Blumenthal, M.D. “Millions of formerly uninsured women have health insurance and are using it to get health care they likely would have gone without before the ACA. It’s essential for us to continue to move forward and build on this progress so everyone has access to high-quality, affordable health care.”

Moving Forward

Policymakers should work to ensure that the 17 million to 18 million people who have coverage through the individual market can successfully enroll this fall, the Commonwealth Fund researchers say. Although the ACA’s individual market reforms have made finding affordable coverage significantly easier, one-third of women still find it difficult. One option to improve premium affordability, the authors note, is to extend eligibility for tax credits to people earning more than 400 percent of poverty (about $50,000 for an individual, and $98,000 for a family of four). In addition, millions of poor women would gain coverage if the 19 states that have not yet expanded eligibility for Medicaid were to move forward.