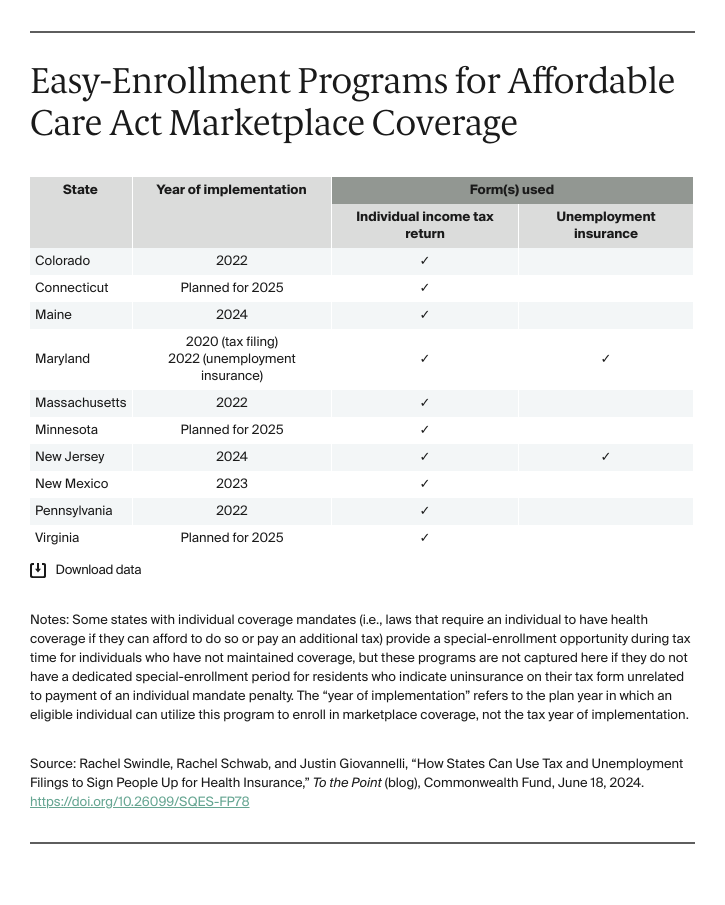

Initial Tax-Filing Enrollment Trends Are Promising

Enrollment data show modest but promising results for states using the tax-filing process to help uninsured residents sign up for coverage. Colorado garnered almost 7,000 marketplace enrollments over the first two years of its program. Between 2020 and mid-2023, more than 13,500 Marylanders enrolled in coverage — marketplace plans or Medicaid — using a check box on tax forms. Pennsylvania reported that several hundred individuals enrolled through “Path to Pennie” in 2022, the program’s inaugural year. In the initial year of New Mexico’s program, the marketplace reported a surge in applications and attributed some of the marketplace enrollment increases in 2023 to people taking advantage of the program’s SEP. Moreover, 78 percent of New Mexico tax filers determined eligible for an easy-enrollment SEP signed up for coverage.

Using Unemployment Insurance Claims May Substantially Increase Program Impact

After two years of enrolling residents in health coverage through the tax-filing process, Maryland expanded its program to include unemployment insurance forms. The economic and financial insecurity associated with job loss — and, frequently, the associated loss of employer-sponsored health insurance — means that many people filing unemployment insurance claims will also be uninsured. Unemployment insurance claims thus offer an ideal outreach opportunity. Monthly SEP data from Maryland shows that there is consistent interest in marketplace coverage among people filing for unemployment insurance.

In the first year of Maryland’s expansion to include unemployment filing, the number of marketplace and Medicaid enrollments surpassed the total number of people who had gained coverage during the first three years of tax filing. In 2023 alone, almost 20,000 people enrolled in a marketplace plan or Medicaid through the unemployment easy-enrollment program. New Jersey, which currently offers easy enrollment through tax filing, will offer this additional path to coverage later in 2024.

Bolstering Easy-Enrollment Programs Through Outreach and Education

Implementing easy-enrollment programs requires some initial and recurring investments in outreach and education. The state-run marketplaces that have established these programs are uniquely positioned to tailor outreach strategies to their population and coordinate with other state agencies to educate consumers, tax filing organizations, and enrollment assisters about the programs. In the months leading up to the launch of Maryland’s program, the state invested in a digital advertising campaign and hosted webinars for tax preparers and enrollment assisters. Colorado’s marketplace prepared informational toolkits and brochures, which it distributed to stakeholders, including community tax-filing organizations. States also can provide a backstop for consumers who find out about the enrollment opportunity after filing taxes; New Mexico offers an SEP to residents who would have checked the box on their tax return had they been made aware of the program by their tax preparer.

Looking Ahead

Initial evidence from easy-enrollment programs suggests these initiatives are an efficient and relatively low-cost mechanism for states to connect uninsured residents to affordable, quality health plans, and may offer bigger benefits over time. Indeed, emerging data from Maryland’s program suggest untapped potential in state processes beyond tax filing to reach consumers in need of affordable coverage. As more states consider creating easy-enrollment pathways, the experience of existing programs will be a valuable source of information.