Millions of Americans struggle to pay their medical bills or pare down medical debt they've accrued. Some 40 to 50 percent of personal bankruptcies, in fact, are caused by medical debt. But here's the real news: even people who have health insurance are not immune.

New analysis of the Commonwealth Fund Biennial Health Insurance Survey (2003) finds that nearly two of five adults (37%)—an estimated 77 million people—struggle with medical bills, have recent or accrued medical debt, or both. Among insured adults, three of five (62%) were insured at the time their medical bill or debt problem occurred. Moreover, there's evidence that medical bill and debt problems take a toll on health—causing people to skip needed care rather than go further into the red.

Seeing Red: Americans Driven into Debt by Medical Bills, by Fund researchers Michelle M. Doty, Ph.D., Jennifer N. Edwards, Dr.P.H., and Alyssa L. Holmgren, considers whether people had difficulty paying medical bills, had been contacted by a collection agency because of unpaid medical bills, or had to change their way of life in order to pay such bills.

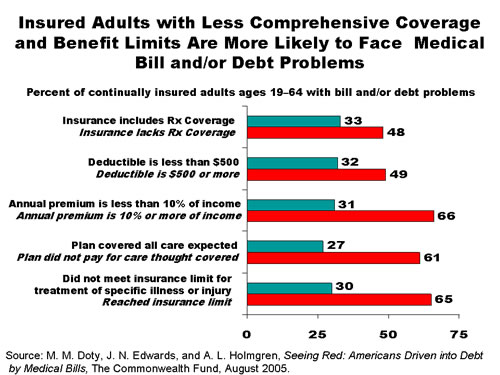

Not surprisingly, the researchers found that the uninsured are the most vulnerable, experiencing medical bill problems at twice the rate of those with coverage. But the "underinsured"—those Americans whose insurance coverage provides inadequate financial protection—face significant medical bill and debt problems as well. Nearly half (48%) of insured adults (19 to 64) whose insurance does not include prescription drug coverage reported problems paying for care, compared with one-third (33%) of those with drug coverage. Nearly two-thirds (65%) of adults who reached the limit of what their insurance plan would pay for a specific treatment or illness experienced medical bill problems, medical debt, or both.

"We should be concerned not only about growing numbers of uninsured Americans, but...those who are insured but still lack financial and health security," said Doty, the report's lead author and a senior analyst at the Fund. "Facing unmanageable medical bills and debt and forgoing medical care because of cost defeats the purpose of health care coverage."

The study found that adults in the survey who had experienced a medical bill problem or had medical debt were significantly more likely than those without such problems to fail to fill a prescription, forgo seeing the doctor, or skip recommended tests or follow-up care. Sixty-three percent of those who had experienced a medical bill problem or medical debt went without needed care, compared with 19 percent of adults who had not experienced such problems.

To protect Americans' financial security and access to care, policymakers need to look more closely at the quality of insurance coverage and benefit design, the researchers say.

"The trend toward higher deductibles in employer plans may have gone too far," noted Fund president Karen Davis, citing the connection between medical debt and high out-of-pocket health care costs. "Greater care should be taken to ensure that health care is affordable for lower-wage workers if all Americans are to get the care they need and preserve savings they will need in retirement," she said.