Although employer health insurance coverage has proved to be relatively stable during the COVID-19 pandemic, the costs of that insurance consume a greater share of working families’ incomes in every state than they did a decade ago, a new Commonwealth Fund report finds. According to the report, State Trends in Employer Premiums and Deductibles, 2010–2020, median incomes have not kept pace with rising health insurance costs and deductibles, which are fueled by high health care and drug prices.

The report is part of the Commonwealth Fund’s ongoing series that looks at state-level trends in the overall cost of employer health insurance. It provides a state-by-state analysis of how much insurance is costing workers in premiums, deductibles, and as a share of income, from 2010 to 2020.

Key findings include:

- Premium contributions and deductibles totaled 11.6 percent of median income in 2020, up from 9.1 percent in 2010. On average, employees’ premium costs amounted to 6.9 percent of income in 2020, an increase from 5.8 percent in 2010. The average annual deductible for a middle-income household amounted to 4.7 percent of income, compared to 3.3 percent in 2010. Together, the average total cost of premiums and potential deductible spending across single and family insurance policies climbed to $8,070. Costs ranged from a low of $6,528 in Hawaii to a high of more than $9,000 in Florida, Kansas, Missouri, South Dakota, and Texas.

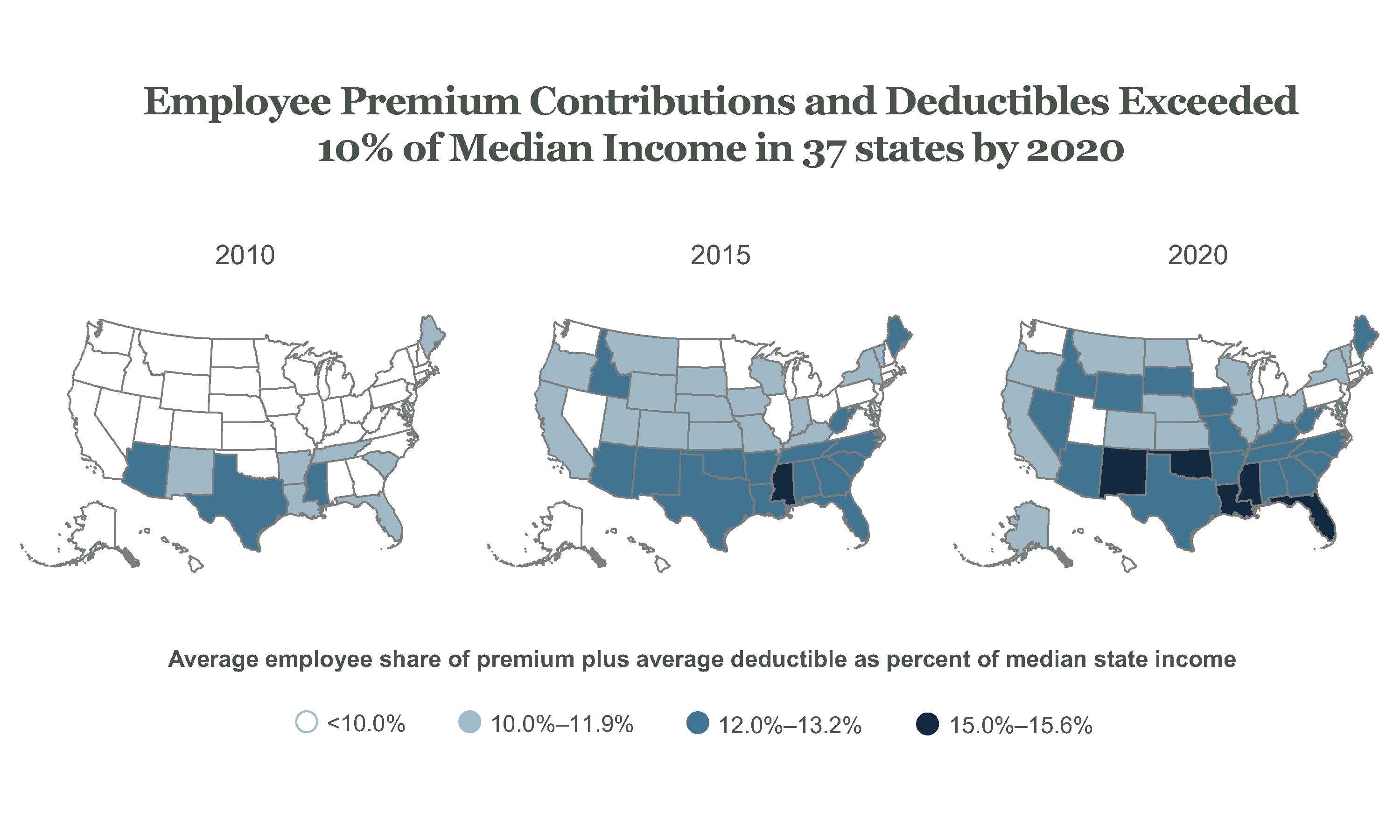

- In a growing number of states, workers are at risk of spending 10 percent or more of their earnings on health insurance premiums and deductibles. In 2020, workers in 37 states passed that threshold, up from 10 states in 2010. Middle-income workers in Mississippi and New Mexico faced the highest potential costs relative to income (19% and 18%, respectively).

- In nearly half of states, middle-income households faced average deductibles that left them underinsured and exposed to high out-of-pocket costs. That’s up from only one state in 2010. The Commonwealth Fund defines one measure of “underinsured” as having a deductible equivalent to 5 percent or more of income. Underinsured people are more likely to struggle to pay medical bills and more likely to skip care because of costs. The highest average deductible relative to median income in 2020 was 7.4 percent, in New Mexico

- Workers in lower-wage companies contribute more to family premiums than workers in higher-wage firms do. Workers in companies with lower average wages paid a larger share of their overall premium for family coverage, on average—and consequently a larger dollar amount—than workers in companies with higher average wages.