Medicare beneficiaries, many of whom live on fixed incomes, look for ways to make the costs of health care more affordable. Prescription drug costs comprise about one-quarter of beneficiaries’ out-of-pocket health care spending each year; most beneficiaries take at least one prescription drug regularly. In 2022, 14 percent of beneficiaries age 65 and older said they skipped a dose or didn’t fill a prescription at the pharmacy because of its costs.

Beneficiaries have options and make trade-offs to lower their costs and afford their prescriptions. One recent option is companies that offer prescription discounts. An increasing number of private, for-profit companies, including GoodRx, Amazon, BlinkRx, and Cost Plus Drugs, offer medication discounts via physical cards or online promotions. But there is one important limitation: beneficiaries cannot use these online discounts with Part D drug coverage.

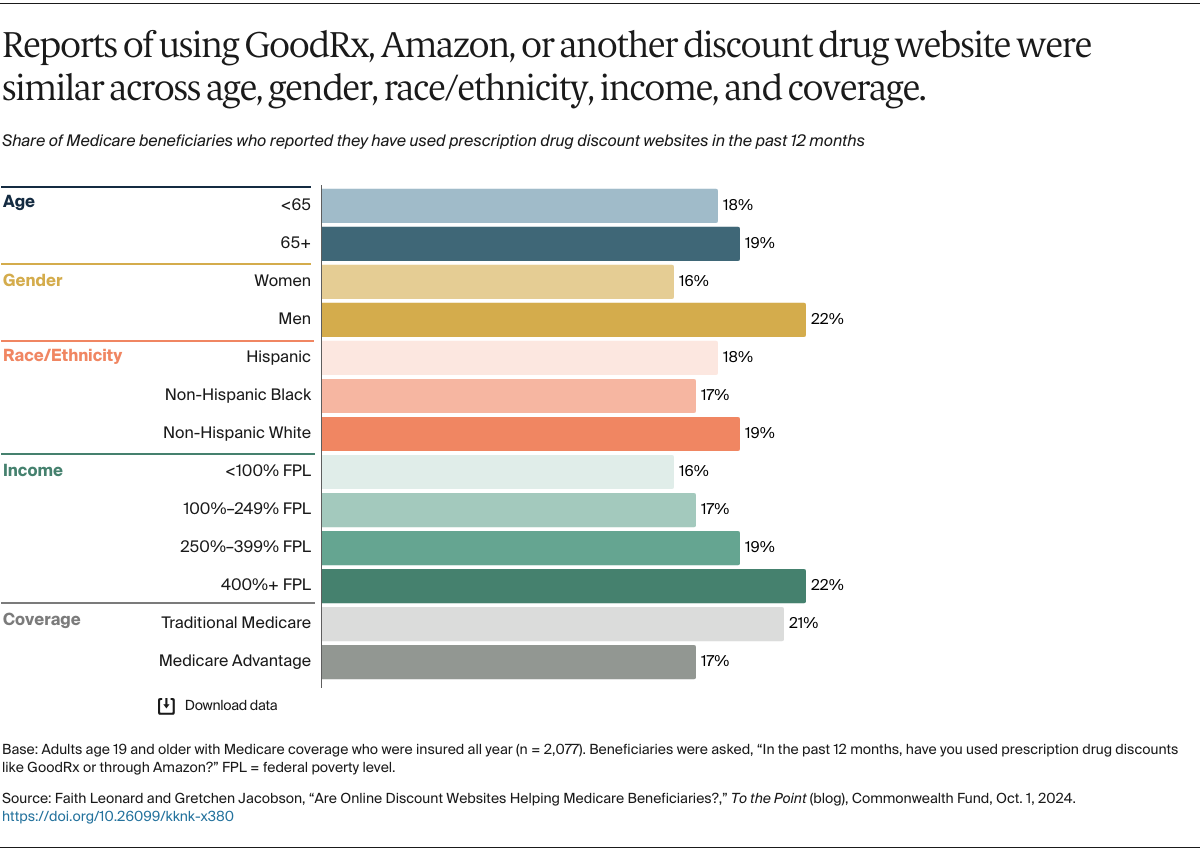

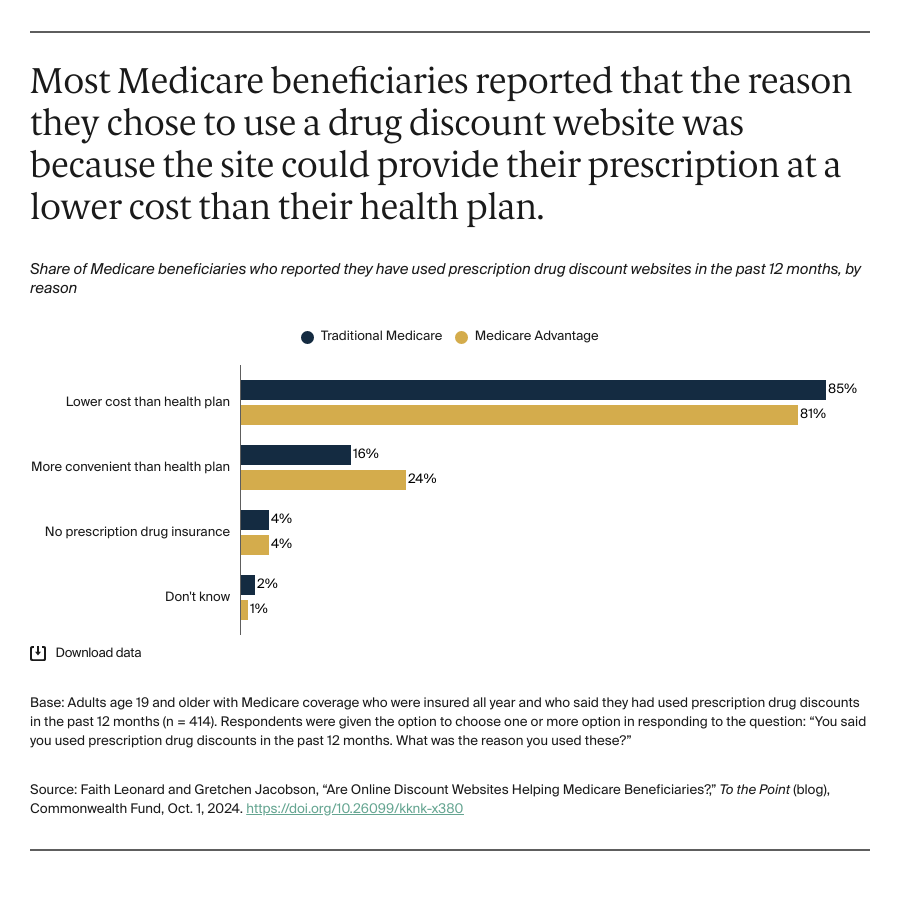

We surveyed Medicare beneficiaries about whether and why they have used these discount sites and then examined their responses by type of Medicare coverage, age, gender, income, and race/ethnicity. These data were collected as part of the Commonwealth Fund 2023 Health Care Affordability Survey and included 2,077 Medicare beneficiaries living in the community (as opposed to nursing homes or other facilities).

How Do GoodRx, Cost Plus Drugs, Amazon, and Other Drug Discount Websites Work for Medicare Beneficiaries?

Medicare beneficiaries may access prescription drugs from the sites in different ways. While GoodRx provides coupons that are brought to pharmacies in-person, Amazon and Cost Plus Drugs provide patients the option of receiving their medications through the mail, and BlinkRx allows patients to select either in-person or mail order.

In certain circumstances, a person with Part D prescription drug coverage may pay less with these discount sites than with their Part D plan. For example, a prescription could cost $400 out-of-pocket at the pharmacy, and $200 with Part D insurance. If GoodRx offers a 55 percent discount on the prescription price, then the beneficiary would pay $180 with GoodRx, a $20 savings over their Part D coverage.

But, beginning in 2025, beneficiaries’ out-of-pocket costs for Part D covered drugs will be limited to $2,000 annually. To have their drug spending count toward this limit, beneficiaries must use their Part D coverage. Thus, discount savings on any particular drug must be compared to the long-term savings that might be achieved by reaching the Part D out-of-pocket limit.

How Many Medicare Beneficiaries Are Using Drug Discount Websites and Why?

About one of five beneficiaries said they had used one of the sites in the past year. There were no significant differences across demographic characteristics, including age, gender, race/ethnicity, and income. The percentage who said they used a prescription drug discount site did not differ significantly among those in Medicare Advantage versus traditional Medicare (17% vs 21%).