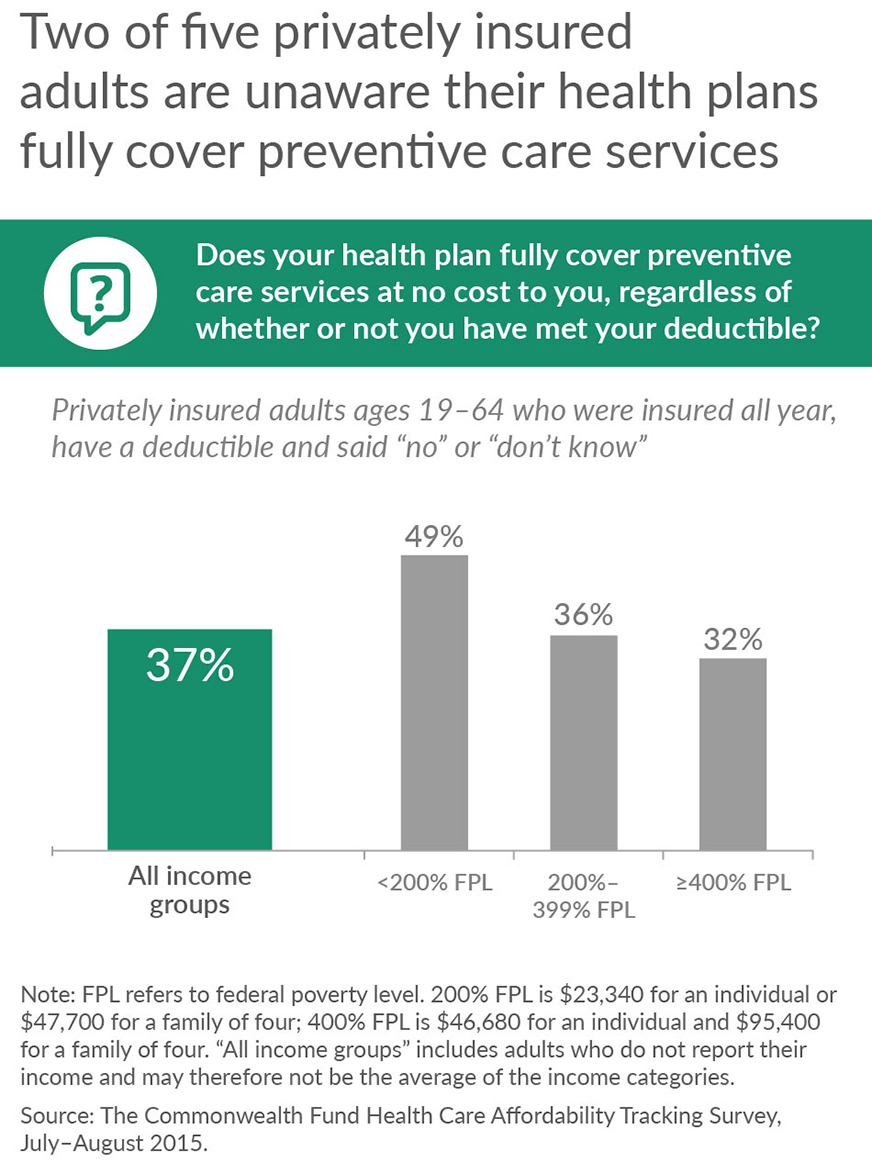

The Affordable Care Act (ACA) requires all health plans to fully cover preventive services, such as cholesterol screenings and mammograms, and prohibits insurance companies from charging copays for them. But findings from the most recent Commonwealth Fund Health Care Affordability Tracking Survey reveal that two of five adults with private coverage are unaware that their health plan fully covered preventive care services—and fully half of privately insured low-income adults are not aware of this benefit.1

Preventive services are free in all health plans, including plans acquired through the ACA marketplace, employers, or the individual market.2 These services do not count toward the deductible that people need to pay before their insurance kicks in. Yet, confusion about what services are covered by health plans is affecting consumers’ health care decisions. According to our survey, 18 percent of privately insured adults who had deductibles that were high relative to their incomes reported they did not get a preventive screening because of the cost.

Consumers with marketplace plans may also be unaware that other services are often excluded from their deductibles. A recent analysis by the Centers for Medicare and Medicaid Services found that more than 80 percent of consumers who selected marketplace plans in 2015 had services in addition to the required preventive services excluded from their deductible.3 For example, 80 percent of consumers who selected silver plans in last year’s enrollment period had primary care visits excluded from their deductible and 82 percent selected a plan in which generic drugs were excluded.4

California’s marketplace, Covered California, requires health plans to exclude physician visits and outpatient services from the deductible for all silver-level and higher plans.5 This means that if patients need treatment after receiving their free preventive care test, they will only be charged their copay for any outpatient treatment.6 The federal marketplace, Healthcare.gov, is also leaning in this direction. The new federal proposed rule for health plans offered in 2017 encourages insurers participating in the federally facilitated marketplace to include certain deductible-free services, such as primary and specialty care visits and generic drugs.7

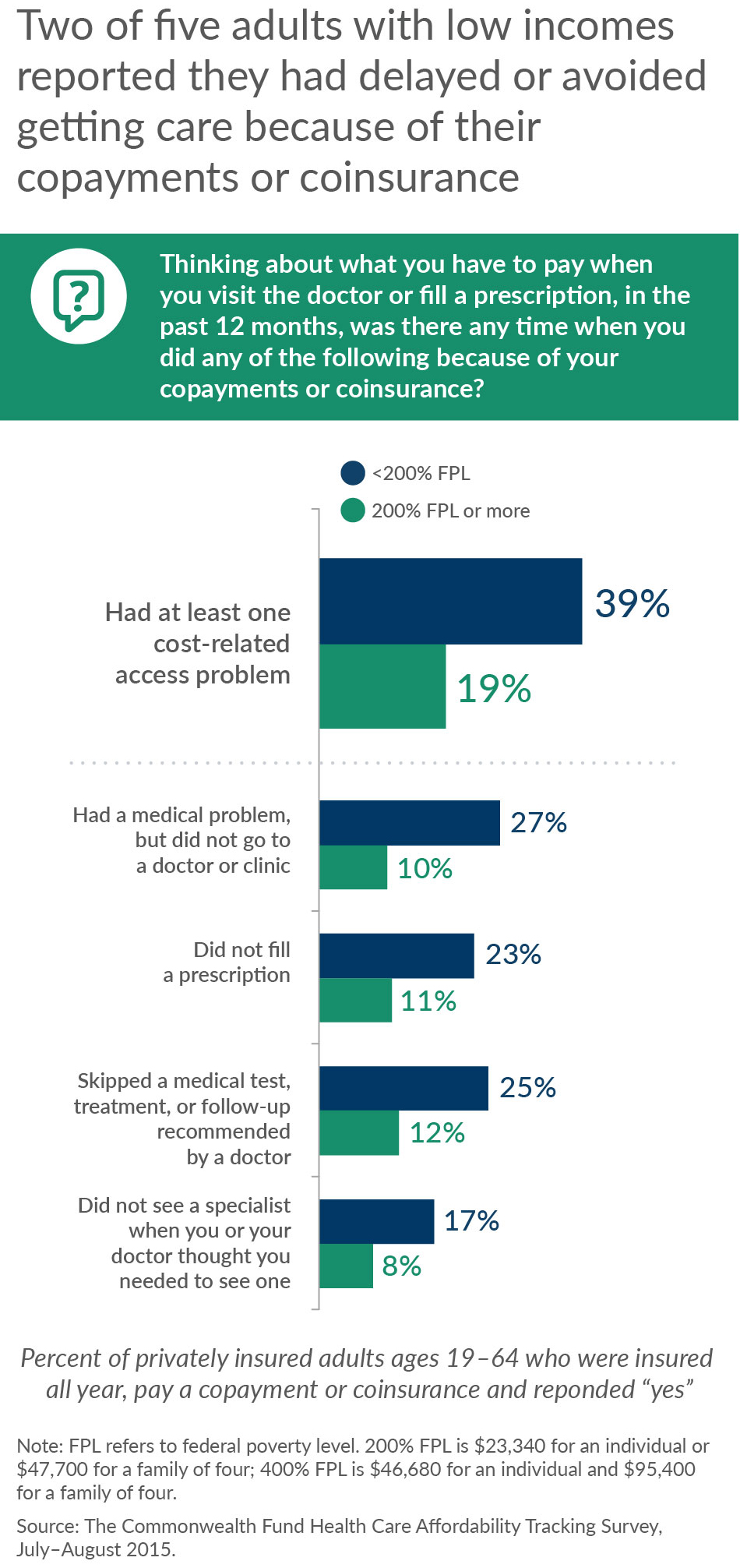

In this third open-enrollment season for marketplace plans, it is important for families who are renewing their coverage, and those planning on enrolling for the first time, to understand their benefit packages. Knowing what is excluded from deductibles will enable people who enroll in high-deductible health plans to take advantage of free-of-charge visits to their doctor to get preventive services and any other follow-up treatment that is included in their benefit package. If consumers are fully aware of what services are covered for free in their health plans, their high deductibles may be less of a barrier to getting timely care.

|

Under the Affordable Care Act, covered preventive services include: those that the United States Preventive Services Task Force rate as either “A” (high certainty that the net benefit is substantial) or “B” (high certainty that the net benefit is moderate); immunizations recommended by the Advisory Committee on Immunization Practices; and an evidence-informed preventive care and screening for infants, children, adolescents, and women, supported by the Health Resources and Services Administration.8 You can learn about which preventive services are fully covered under the Affordable Care Act by visiting HealthCare.gov.9 |

Notes

1 S. R. Collins, M. Gunja, M. M. Doty, and S. Beutel, How High Is America’s Health Care Cost Burden? Findings from the Commonwealth Fund Health Care Affordability Tracking Survey, July-August 2015, The Commonwealth Fund, November 2015.

2 Grandfathered plans are excluded from this provision.

3 For plans without cost-sharing subsidies.

4 K. Counihan, Five Facts About Deductibles, The CMS Blog, Centers for Medicare and Medicaid Services, Nov. 17, 2015.

5 Outpatient services are tests, treatments, and/or procedures that can be performed without requiring the patient to stay overnight in a medical center

6 J. C. Robinson, P. Lee, and Z. Goldman, Whither Health Insurance Exchanges Under the Affordable Care Act? Active Purchasing Versus Passive Marketplaces, Health Affairs Blog, Oct. 2, 2015.

7 T. Jost, Proposed Benefits and Payments Rules Includes Standardized Plans, New Network Adequacy Standards, Health Affairs Blog, Nov. 20, 2015.

8 Centers for Medicare and Medicaid Services, Affordable Care Act Implementation FAQs-Set 12 (Washington, D.C.: CMS).

9 10 Health Care Benefits Covered in the Health Insurance Marketplace, Healthcare.gov Blog, Aug. 22, 2013.